Retail Sales Forecasting with Ensemble Methods

Sales Data Analysis and Forecasting Using Ensemble Methods

Sales forecasting is a critical business function that helps organizations make informed decisions about inventory management, resource allocation, and strategic planning. Accurate sales predictions can lead to:

- Optimized inventory levels and reduced carrying costs

- Better cash flow management

- Improved customer satisfaction through product availability

- More effective marketing and promotional strategies

- Data-driven business planning and goal setting

In this guide, we’ll explore how to build a robust sales forecasting system using ensemble methods, specifically Random Forest and XGBoost. We’ll work with the Rossmann Store Sales dataset, which contains historical sales data from over 1,000 stores. The dataset presents real-world challenges including:

- Missing values and inconsistent data

- Multiple categorical and numerical features

- Temporal dependencies and seasonality

- Store-specific characteristics and promotions

We’ll cover the entire machine learning pipeline from data preprocessing to model evaluation, with a focus on:

- Data cleaning and feature engineering

- Exploratory data analysis and visualization

- Building and comparing ensemble models

- Model evaluation and interpretation

The techniques demonstrated here can be applied to various time series forecasting problems beyond retail sales.

Dataset Overview

The data is available on Kaggle: Rossmann Store Sales Competition

The data contains sales information for 1115 Rossmann drug stores.

These are some of the features in the dataset:

- Id - an Id that represents a (Store, Date) duple within the test set

- Store - a unique Id for each store

- Sales - the turnover for any given day (this is what you are predicting)

- Customers - the number of customers on a given day

- Open - an indicator for whether the store was open: 0 = closed, 1 = open

- StateHoliday - indicates a state holiday. Normally all stores, with few exceptions, are closed on state holidays. Note that all schools are closed on public holidays and weekends. a = public holiday, b = Easter holiday, c = Christmas, 0 = None

- SchoolHoliday - indicates if the (Store, Date) was affected by the closure of public schools

- StoreType - differentiates between 4 different store models: a, b, c, d

- Assortment - describes an assortment level: a = basic, b = extra, c = extended

- CompetitionDistance - distance in meters to the nearest competitor store

- CompetitionOpenSince[Month/Year] - gives the approximate year and month of the time the nearest competitor was opened

- Promo - indicates whether a store is running a promo on that day

- Promo2 - Promo2 is a continuing and consecutive promotion for some stores: 0 = store is not participating, 1 = store is participating

- Promo2Since[Year/Week] - describes the year and calendar week when the store started participating in Promo2

- PromoInterval - describes the consecutive intervals Promo2 is started, naming the months the promotion is started anew. E.g. “Feb,May,Aug,Nov” means each round starts in February, May, August, November of any given year for that store

Let’s begin by exploring and preparing our data for analysis.

Data Collection and Setup

First, we’ll import the necessary libraries and configure our environment. We’re using:

- pandas & numpy: For data manipulation and numerical operations

- matplotlib & seaborn: For data visualization

- sklearn: For machine learning models and evaluation metrics

- tensorflow: For potential deep learning extensions

- warnings: To suppress unnecessary warning messages

# Import necessary libraries

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import seaborn as sns

import datetime as dt

import tensorflow as tf

from tensorflow import keras

from sklearn.ensemble import RandomForestRegressor

from sklearn.model_selection import train_test_split

from sklearn.metrics import mean_squared_error, mean_absolute_error, r2_score

import os

import zipfile

import warnings

warnings.filterwarnings('ignore')

# Set style and color palette

sns.set(style='darkgrid', palette='mako')

# Change the setting and put it in a dictionary

plot_settings = {

'font.family': 'calibri',

'axes.titlesize': 18,

'axes.labelsize': 14,

'figure.dpi': 140,

'axes.titlepad': 15,

'axes.labelpad': 15,

'figure.titlesize': 24,

'figure.titleweight': 'bold',

}

# Use the dictionary variable to update the settings using matplotlib

plt.rcParams.update(plot_settings)Next, we’ll download the dataset using the Kaggle API and read the data. The dataset consists of several CSV files:

train.csv: Historical sales data for trainingstore.csv: Additional information about each storetest.csv: Data for prediction

# Download the data from kaggle

#! kaggle competitions download -c rossmann-store-sales

'''# Unzip the data

with zipfile.ZipFile('rossmann-store-sales.zip', 'r') as zip_ref:

zip_ref.extractall('rossmann-store-sales')

# Delete the zip file

os.remove('rossmann-store-sales.zip')'''

# Read the data

train = pd.read_csv('rossmann-store-sales/train.csv')

store = pd.read_csv('rossmann-store-sales/store.csv')

test = pd.read_csv('rossmann-store-sales/test.csv')

# Inspect the data

train.info()

# Check the head of the data

train.head()Understanding the Data Structure

Let’s examine the StateHoliday column, which uses categorical encoding:

- 0: Regular day

- a: Public holiday

- b: Easter holiday

- c: Christmas

# Check the value counts of StateHoliday

train.StateHoliday.value_counts()We notice that the StateHoliday column uses mixed data types (both numeric and string values for 0). Let’s standardize this by converting all values to numeric:

# Convert the StateHoliday column to int64

train['StateHoliday'] = train['StateHoliday'].replace(['a', 'b', 'c'], [1, 2, 3]).astype('int64')

# Check the value counts again

train.StateHoliday.value_counts()

# Convert the Date column to datetime

train['Date'] = pd.to_datetime(train['Date'])

# Inspect the data

train.info()

# Check the head of the data

train.head()This standardization is important because:

- Consistent data types improve model performance

- Integer encoding is more memory efficient than string encoding

- Many machine learning algorithms require numeric inputs

Let’s examine the distribution of values across all columns to identify any potential data quality issues:

# Check the value counts of each column to check for inconsistencies

for col in train.columns:

print('Column: ', col, '

', train[col].value_counts(), '

')Exploratory Data Analysis

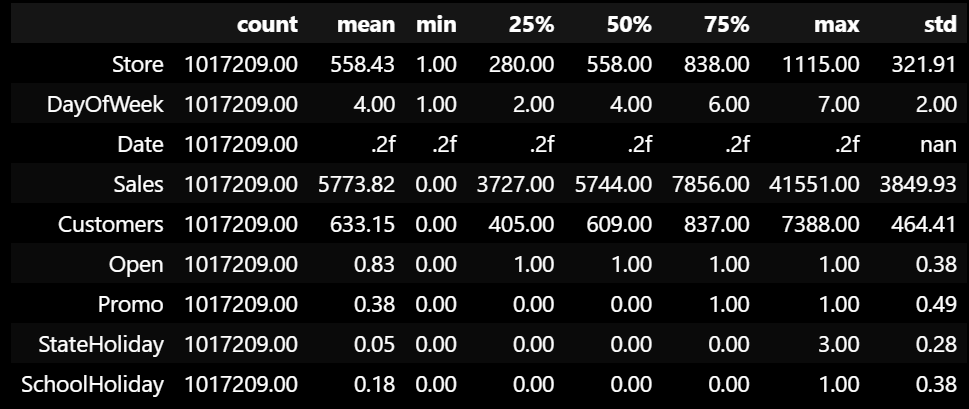

Let’s start by examining the summary statistics of our data to understand the distribution of our numerical variables:

# Display the summary statistics of the data

train.describe().T.style.format('{:.2f}')

Feature Engineering

To enrich our dataset, we’ll extract temporal features from the date column and create a sales per customer metric:

# Extract the year, month, week, and day from the date column

train['Year'] = train['Date'].dt.year

train['Month'] = train['Date'].dt.month

# Isocalendar returns a tuple of (year, week, weekday) for each date

train['Week'] = train['Date'].apply(lambda x: x.isocalendar()[1])

train['Day'] = train['Date'].dt.day

# Add a new feature for sales per customer

train['SalesPerCustomer'] = train['Sales'] / train['Customers']

# Display the summary statistics of the SalesPerCustomer column

train['SalesPerCustomer'].describe()count 844340.000000

mean 9.493619

std 2.197494

min 0.000000

25% 7.895563

50% 9.250000

75% 10.899729

max 64.957854

The sales per customer metric reveals interesting insights:

- Average spend is 9.49 euros per customer per day

- Maximum spend is 64.9 euros

- Standard deviation is 2.19 euros

- Missing values indicate days with no customers

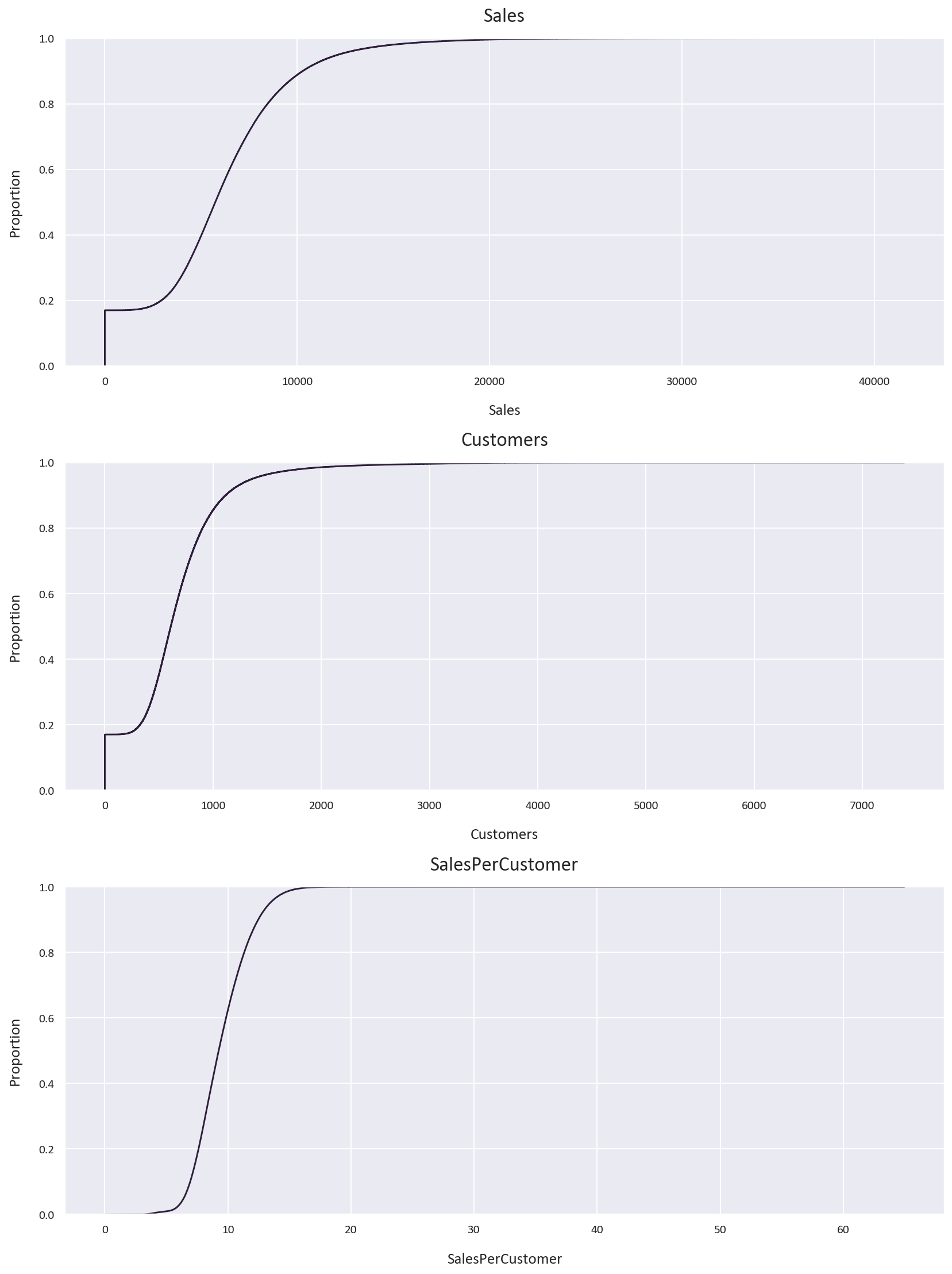

Distribution Analysis

To better understand our data distributions, we’ll use Empirical Cumulative Distribution Functions (ECDF). ECDFs are powerful visualization tools that show:

- The complete distribution of the data

- The probability of a value being less than or equal to any given point

- Any potential outliers or anomalies

# Perform Empirical Cumulative Distribution Function (ECDF) analysis on the data

plt.figure(figsize=(12, 16))

plt.subplot(3, 1, 1)

sns.ecdfplot(data=train, x='Sales')

plt.title('Sales')

plt.subplot(3, 1, 2)

sns.ecdfplot(data=train, x='Customers')

plt.title('Customers')

plt.subplot(3, 1, 3)

sns.ecdfplot(data=train, x='SalesPerCustomer')

plt.title('SalesPerCustomer')

plt.tight_layout()

Key observations from the ECDFs:

- Sales distribution is right-skewed with 90% of sales below 10,000 euros

- Customer count is also right-skewed with 80% of days having fewer than 1,000 customers

- Sales per customer follows a more normal distribution with 60% below 10 euros

We can also see that under 20% of the data has 0 sales or 0 customers, let’s explore this further. Is it because the store is closed or is it because there are no customers? Let’s investigate this:

# Check for missing values in the data

train.isnull().sum()

# Check for days that the stores were closed

train[train['Open'] == 0].shape

# Check for days that the stores were open and had no customers

train[(train['Open'] == 1) & (train['Customers'] == 0)].shape

# Add the two conditions together to get the total number

# of days that the stores were closed or had no customers

train[(train['Open'] == 0) | ((train['Open'] == 1) & (train['Customers'] == 0))].shape(172817, 14)

(52, 14)

(172869, 14)

The missing values in SalesPerCustomer come from:

- Days when stores were closed (172817)

- Days with zero customers despite being open (52)

For our analysis, we’ll remove these rows as they could introduce bias into our models:

# Drop the rows where the stores were closed or had no customers

train = train[(train['Open'] == 1) & (train['Customers'] != 0)]

# Check for missing values again

train.isnull().sum()

# Check the shape of the data

train.shapeStore 0

DayOfWeek 0

Date 0

Sales 0

Customers 0

Open 0

Promo 0

StateHoliday 0

SchoolHoliday 0

Year 0

Month 0

Week 0

Day 0

SalesPerCustomer 0

(844340, 14)

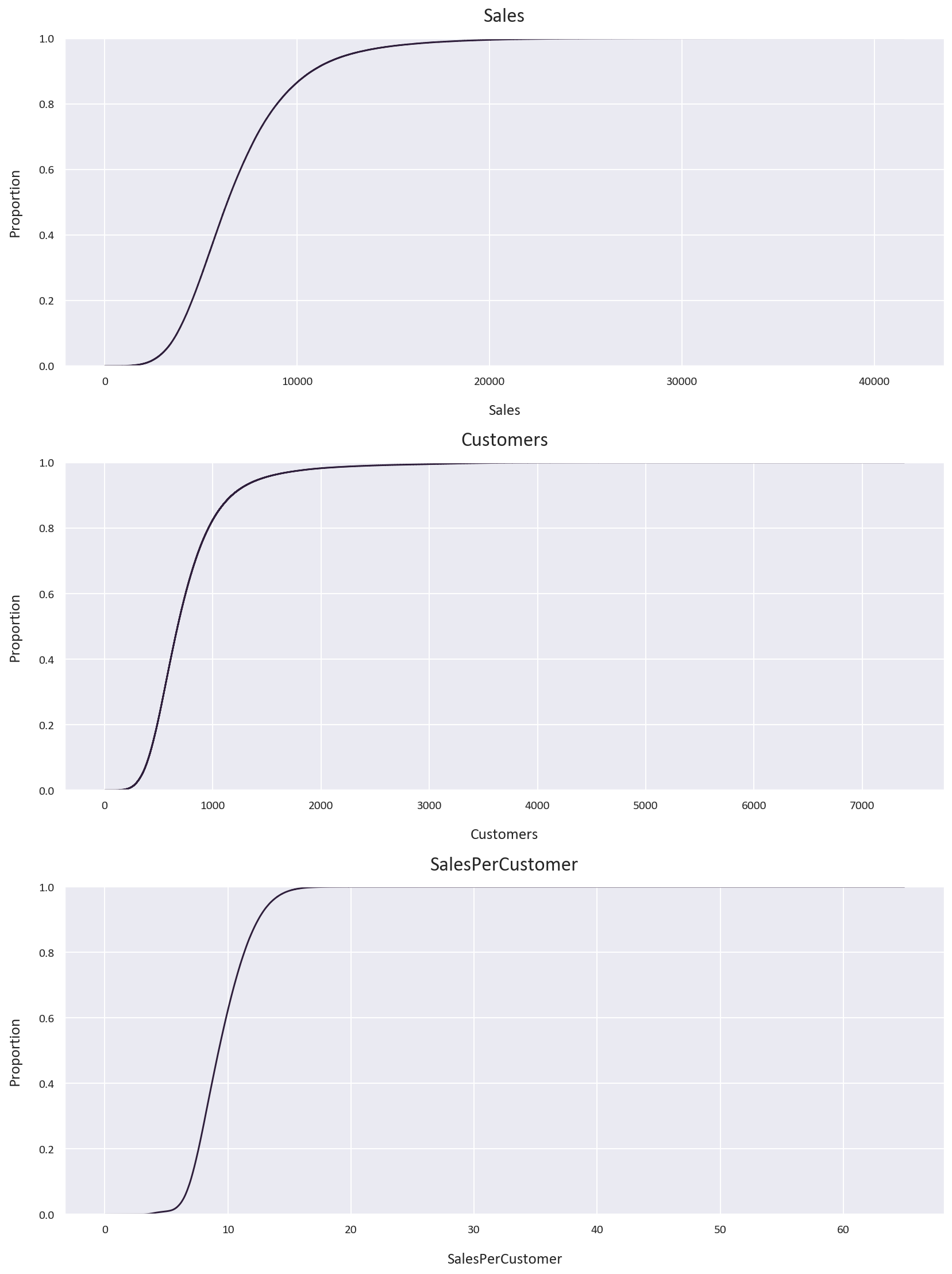

Let’s visualize the distributions again after cleaning:

# Perform ECDF analysis on the data again

plt.figure(figsize=(12, 16))

plt.subplot(3, 1, 1)

sns.ecdfplot(data=train, x='Sales')

plt.title('Sales')

plt.subplot(3, 1, 2)

sns.ecdfplot(data=train, x='Customers')

plt.title('Customers')

plt.subplot(3, 1, 3)

sns.ecdfplot(data=train, x='SalesPerCustomer')

plt.title('SalesPerCustomer')

plt.tight_layout()

Since the ‘Open’ column now contains only 1 value, we can drop it:

# Drop the open column

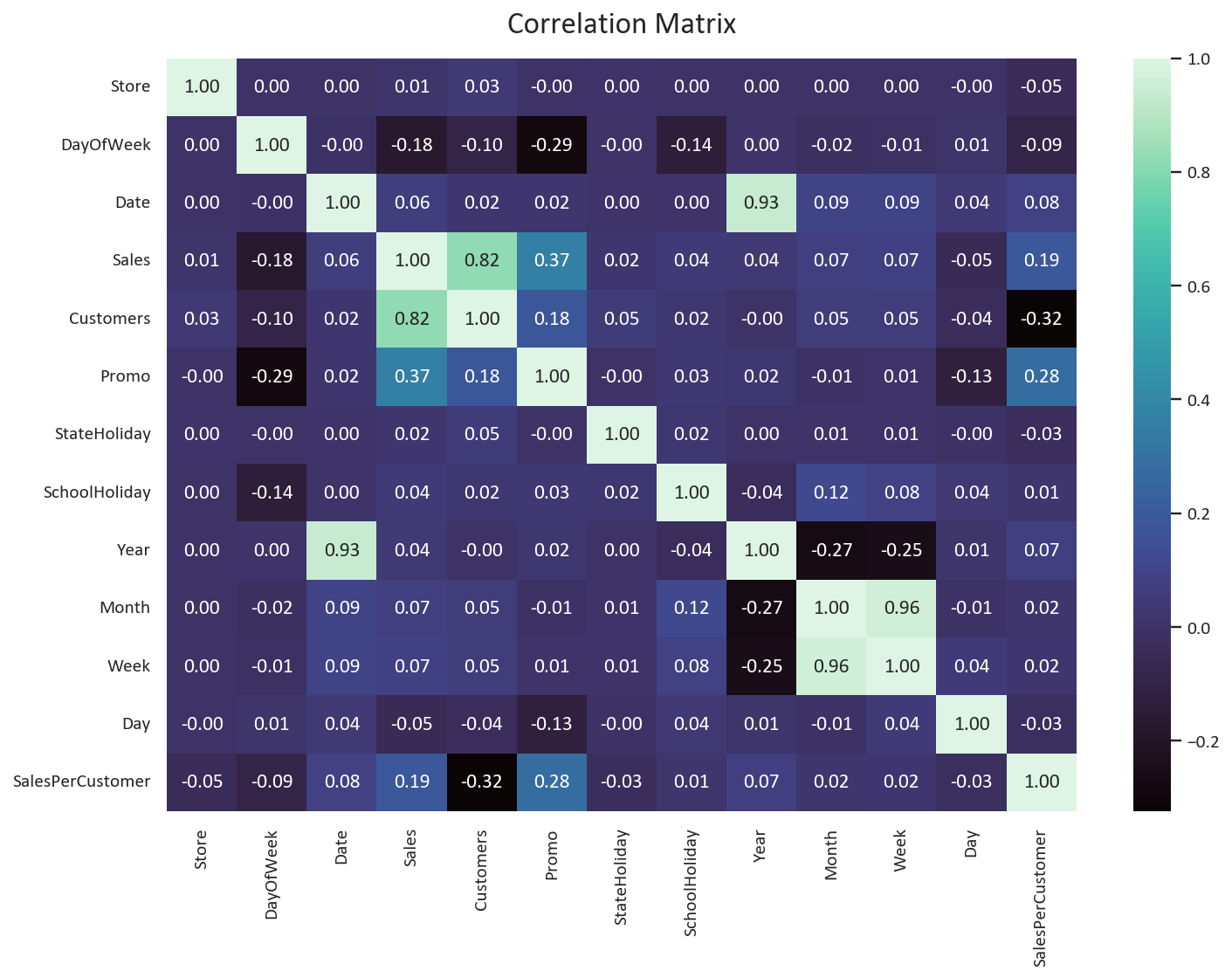

train.drop('Open', axis=1, inplace=True)Correlation Analysis

Understanding feature relationships is crucial for model selection and feature engineering:

# Visualize the correlation matrix of the data

plt.figure(figsize=(12, 8))

sns.heatmap(train.corr(), annot=True, cmap='mako', fmt='.2f')

plt.title('Correlation Matrix')

Key insights from the correlation matrix:

- Year shows weak correlations - expected due to limited time range (2013-2015), it should be dropped.

- Later months and weeks show higher sales and customer counts - potential seasonal effects

- Day of month has negative correlation with sales and customers - possible salary cycle effect

- DayOfWeek shows negative correlation - unexpected pattern worth investigating

While these temporal features show modest correlations, they may still provide valuable signals for our predictive model.

# Drop the year column

train.drop('Year', axis=1, inplace=True)# How many days of the week are the stores open?

train['DayOfWeek'].value_counts()

# Which stores are open on Sundays?

train[train['DayOfWeek'] == 7]['Store'].unique()

# What percentage of the stores are open on Sundays?

len(train[train['DayOfWeek'] == 7]['Store'].unique()) / len(train['Store'].unique()) * 100DayOfWeek

6 144052

2 143956

3 141922

5 138633

1 137557

4 134627

7 3593

array([ 85, 122, 209, 259, 262, 274, 299, 310, 335, 353, 423,

433, 453, 494, 512, 524, 530, 562, 578, 676, 682, 732,

733, 769, 863, 867, 931, 948, 1045, 1081, 1097, 1099, 877],

dtype=int64)

2.9596412556053813

As we suspected, only 2.95% of the stores are open on Sundays. This explains the negative correlation between the DayOfWeek column and the sales and customers columns.

This can introduce bias to our model, so we can drop the DayOfWeek column.

# Drop the DayOfWeek column

train.drop('DayOfWeek', axis=1, inplace=True)Store Data Analysis

Now let’s explore the store data.

The store dataset contains important metadata about each store location. Let’s examine its structure:

# Check the head of the data

store.head()

# Inspect the store data

store.info() # Column Non-Null Count Dtype

--- ------ -------------- -----

0 Store 1115 non-null int64

1 StoreType 1115 non-null object

2 Assortment 1115 non-null object

3 CompetitionDistance 1112 non-null float64

4 CompetitionOpenSinceMonth 761 non-null float64

5 CompetitionOpenSinceYear 761 non-null float64

6 Promo2 1115 non-null int64

7 Promo2SinceWeek 571 non-null float64

8 Promo2SinceYear 571 non-null float64

9 PromoInterval 571 non-null object

The store data includes several important features:

- Store: Unique identifier for each store

- StoreType: Categories a, b, c, d representing different store types

- Assortment: Product Assortment levels (a = basic, b = extra, c = extended)

- CompetitionDistance: Distance in meters to nearest competitor store

- CompetitionOpenSince(Month/Year): When the nearest competitor opened

- Promo2: Promo2 is a continuing promotion for some stores: 0 = store is not participating, 1 = store is participating

- Promo2Since(Year/Week): The year and calendar week when the store started participating in Promo2

- PromoInterval: The consecutive intervals Promo2 is started, naming the months the promotion is started anew. E.g. “Feb,May,Aug,Nov” means each round starts in February, May, August, November of any given year for that store

Let’s handle missing values in the store dataset:

# Check for missing values in the data

store.isnull().sum()

# Check the missing values in the CompetitionDistance column

store[store['CompetitionDistance'].isnull()]

# Fill the missing values with the mean since the data is continuous

store['CompetitionDistance'].fillna(store['CompetitionDistance'].mean(), inplace=True)

# Check the missing values in the CompetitionOpenSinceMonth column

store[store['CompetitionOpenSinceMonth'].isnull()]

# Fill the missing values with 0

store['CompetitionOpenSinceMonth'].fillna(0, inplace=True)

store['CompetitionOpenSinceYear'].fillna(0, inplace=True)

# Check the missing values in the Promo2SinceWeek column

promo_missing = store[store['Promo2SinceWeek'].isnull()]Store 0

StoreType 0

Assortment 0

CompetitionDistance 3

CompetitionOpenSinceMonth 354

CompetitionOpenSinceYear 354

Promo2 0

Promo2SinceWeek 544

Promo2SinceYear 544

PromoInterval 544

Our missing value strategy varies by feature type:

-

Competition Distance (Continuous Variable)

- Fill with mean value

- Preserves distribution characteristics

- Maintains statistical relationships

-

Competition Open Since (Temporal Variable)

- Fill with 0 to indicate no competition

- Logical placeholder for missing temporal data

- Maintains data consistency

-

Promo2SinceWeek, Promo2SinceYear, and PromoInterval (Categorical Variable)

- Fill with 0 for non-participating stores

- Consistent with business logic

- Preserves promotional patterns

Let’s verify our assumption about Promo2 missing values:

# Are there any stores that have Promo2 as 1 but the Promo2SinceWeek is null?

promo_missing[promo_missing['Promo2'] == 1].shape

# Fill the remaining missing values with 0

store.fillna(0, inplace=True)

# Make sure there are no missing values in the data

store.isnull().sum()(0, 10)

As we assumed, the missing values in the Promo2SinceWeek, Promo2SinceYear, and PromoInterval columns are because the stores are not participating in Promo2. We can simply fill these values with 0 as the information is not available.

Time-based Analysis

For effective time series analysis, we need to:

- Set the date as our index for time-based operations and sort the index from oldest to newest, which will make plotting the data easier.

- Convert categorical variables to numeric format

- Calculate competition duration features

# Merge the train and store data on the Store column

df = pd.merge(train, store, on='Store')

# Set the Date column as the index

df.set_index('Date', inplace=True)

# Sort the index in ascending order

df.sort_index(inplace=True)

# Convert categorical variables to numeric

df['StoreType'] = df['StoreType'].replace(['a', 'b', 'c', 'd'], [1, 2, 3, 4])

df['Assortment'] = df['Assortment'].replace(['a', 'b', 'c'], [1, 2, 3])

# Calculate competition duration

df['CompetitionOpenMonths'] = 12 * (df.index.year - df['CompetitionOpenSinceYear']) + (df['Month'] - df['CompetitionOpenSinceMonth'])The competition duration calculation requires careful handling of edge cases:

# Check for stores with no competition data

zero_comp = df[df['CompetitionOpenSinceMonth'] == 0]

print(f"Stores with no competition data: {len(zero_comp)}")

# Verify if missing month and year data align

month_year_match = (df[df['CompetitionOpenSinceMonth'] == 0].index == df[df['CompetitionOpenSinceYear'] == 0].index).all()

print(f"Missing month and year data match: {month_year_match}")

# Set competition months to 0 for stores with no competition

df.loc[df['CompetitionOpenSinceMonth'] == 0, 'CompetitionOpenMonths'] = 0

# Check for outliers in competition duration

outliers = df[df['CompetitionOpenMonths'] > 1200]

print(f"Stores with competition duration > 100 years: {len(outliers)}")

# Fix incorrect historical data (store 815 showing competition since 1900)

df.loc[df['Store'] == 815, 'CompetitionOpenMonths'] = 0After cleaning the competition data, we found:

- 268,602 rows have 0 values in the CompetitionOpenSinceMonth and CompetitionOpenSinceYear columns, which causes CompetitionOpenMonths to have huge values. As this is a huge portion of the data, we should set the CompetitionOpenMonths to 0 for these stores.

- One store had an incorrect competition date (year 1900), we also set the CompetitionOpenMonths to 0 for this store.

- Remaining durations are within reasonable ranges

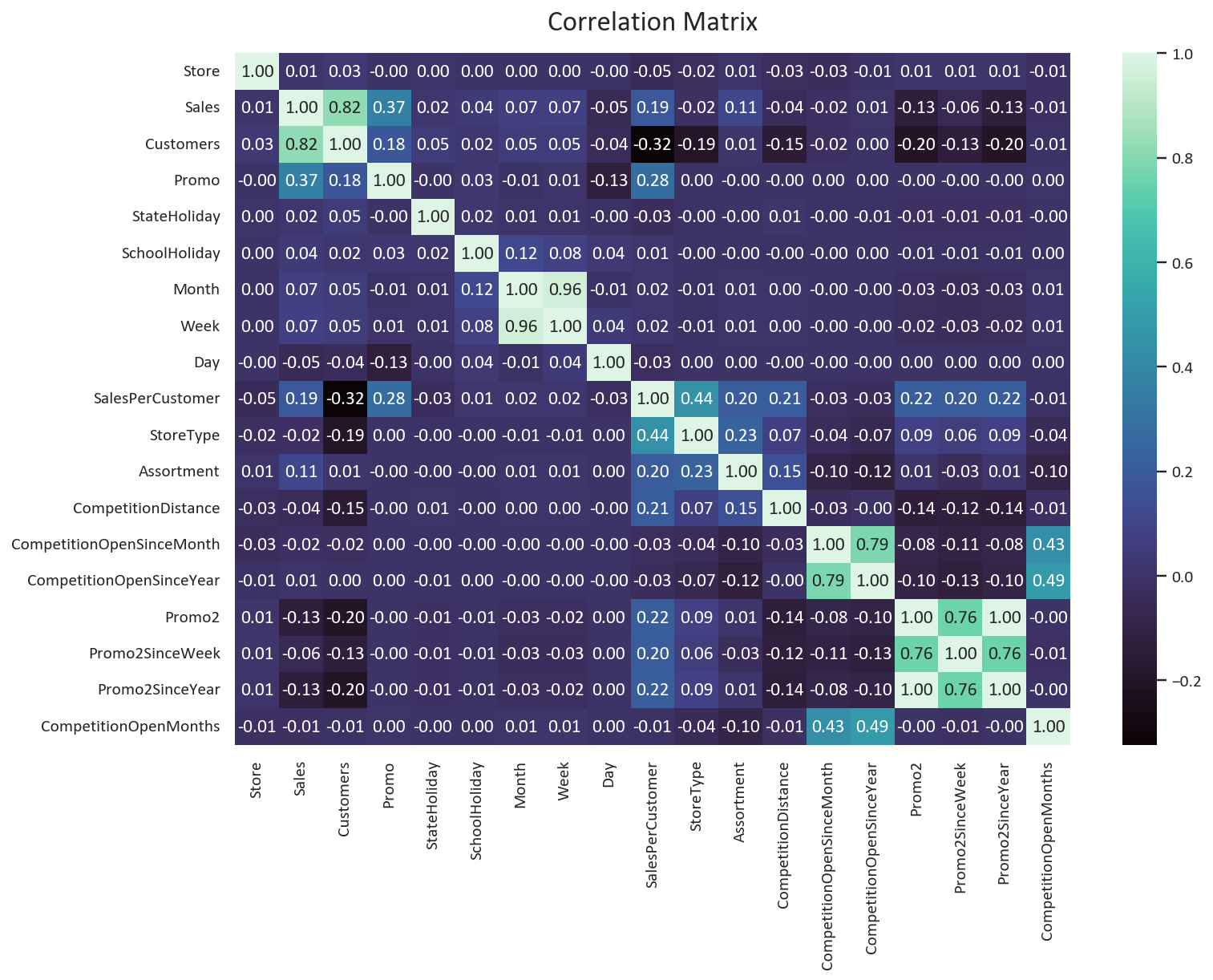

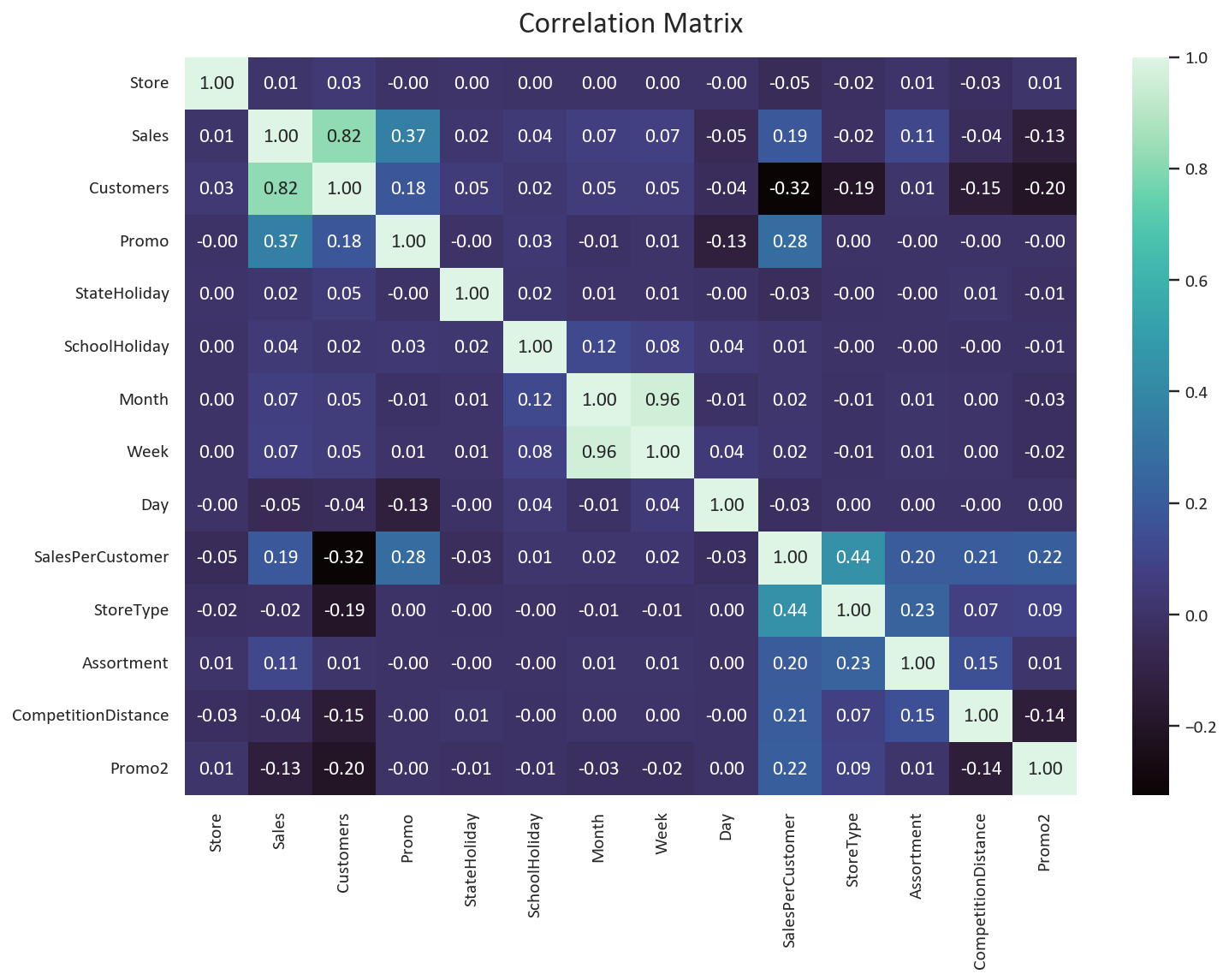

Let’s analyze the relationship between competition and sales:

# Plot correlation matrix focusing on competition metrics

competition_cols = ['Sales', 'Customers', 'CompetitionDistance',

'CompetitionOpenMonths', 'Promo', 'Promo2']

plt.figure(figsize=(10, 8))

sns.heatmap(df[competition_cols].corr(), annot=True, cmap='mako', fmt='.2f')

plt.title('Competition Impact Correlation Matrix')

plt.tight_layout()

Key findings about competition:

- Competition distance has a negative correlation with customers (-0.15) and sales (-0.04).

- Competition duration shows minimal impact on sales (+-0.02). We can safely drop the CompetitionOpenSinceMonth, CompetitionOpenSinceYear, and CompetitionOpenMonths columns.

- The Promo feature have strong positive correlation (Sales: 0.37, Customers: 0.18) but the correlation for the Promo2 feature is also negative (Sales: -0.13, Customers: -0.20).

Based on these insights, we can simplify our feature set:

# Remove low-impact competition features

df.drop(['CompetitionOpenSinceMonth', 'CompetitionOpenSinceYear',

'CompetitionOpenMonths', 'Promo2SinceWeek',

'Promo2SinceYear', 'PromoInterval'], axis=1, inplace=True)

# Verify remaining features

print("Final feature set:")

for col in df.columns:

print(f"- {col}")The negative correlation between competition distance and sales suggests that:

- Stores in high-density areas have more competition but also more customers

- Competition might be a proxy for location desirability

- Urban locations tend to have both higher sales and more competition

This counterintuitive relationship highlights why we should keep the competition distance feature despite dropping other competition-related columns.

The negative correlation between Promo2 and Sales/Customers suggests that:

- Stores that are participating in consecutive promotions have lower sales/customers.

- The scarcity aspect of promotions might be more important than the duration.

The final feature set is:

- Store

- Sales

- Customers

- Promo

- Promo2

- CompetitionDistance

- StateHoliday

- SchoolHoliday

- Month

- Week

- Day

- SalesPerCustomer

- StoreType

- Assortment

Data Analysis & Data Visualization

# Check the skewness of the Sales, Customers, and SalesPerCustomer columns

print('Skewness of Sales: ', df['Sales'].skew())

print('Skewness of Customers: ', df['Customers'].skew())

print('Skewness of SalesPerCustomer: ', df['SalesPerCustomer'].skew())

# Check the kurtosis of the Sales, Customers, and SalesPerCustomer columns

print('Kurtosis of Sales: ', df['Sales'].kurt())

print('Kurtosis of Customers: ', df['Customers'].kurt())

print('Kurtosis of SalesPerCustomer: ', df['SalesPerCustomer'].kurt())Skewness of Sales: 1.594891526556365

Skewness of Customers: 2.789027509620191

Skewness of SalesPerCustomer: 0.592159884112242

Kurtosis of Sales: 4.853951932461696

Kurtosis of Customers: 13.317902861755178

Kurtosis of SalesPerCustomer: 2.7593910840541587

Based on the Skewness of the data, we can see that the sales and customers data are skewed to the right, while the sales per customer data is closer to the normal distribution.

As for Kurtosis, we can see that the customers data has the highest Kurtosis, which means that it has the most outliers. The sales data is next, while the sales per customer data has the lowest Kurtosis.

This means that the sales per customer data is the closest to the normal distribution.

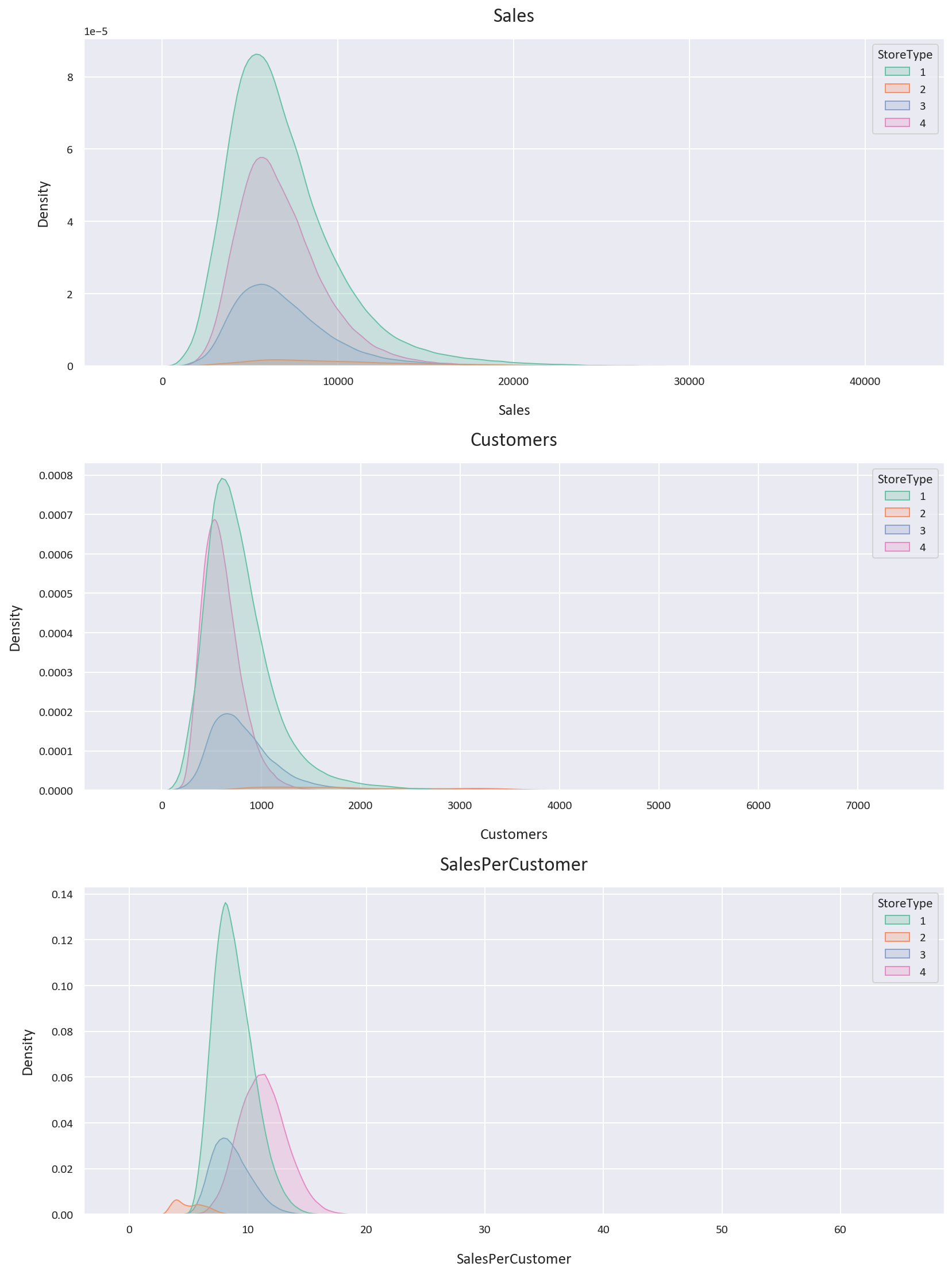

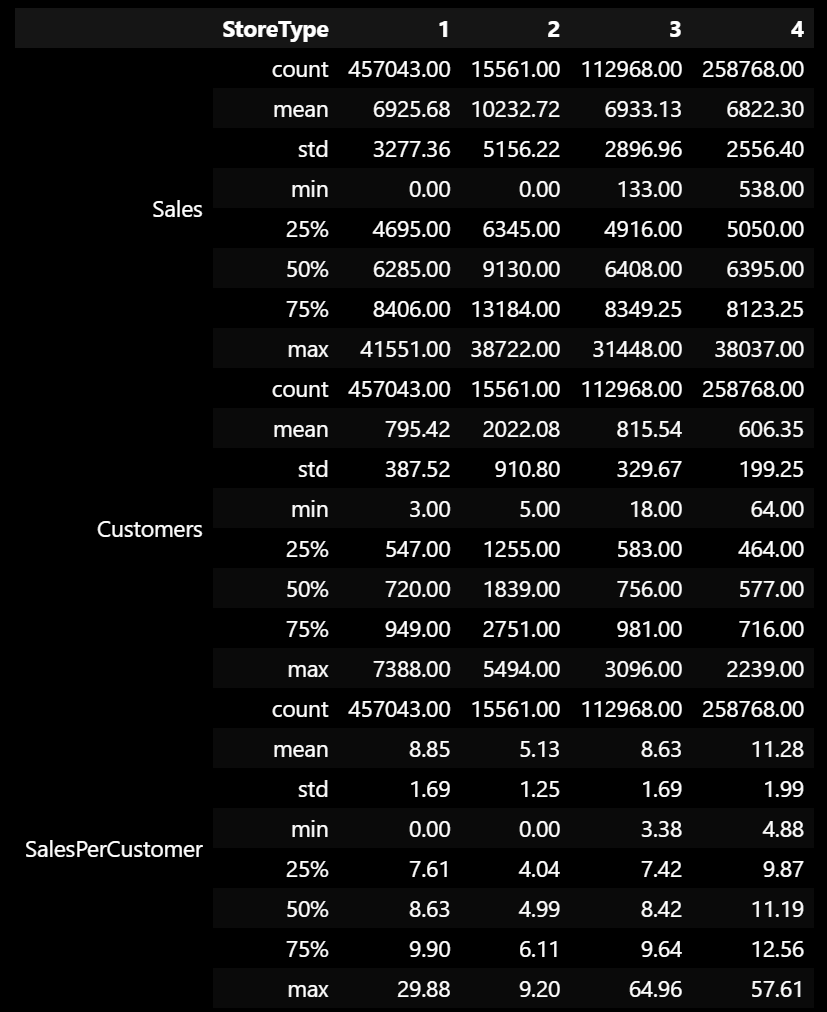

Next, let’s plot the KDE plot for the Sales, Customers, and SalesPerCustomer columns based on the StoreType to visualize the distribution of the data.

The KDE plot confirms our previous findings, with the sales and customers data being skewed to the right, while the sales per customer data is closer to the normal distribution. We also notice that the storetype 1 is the most dense of the storetypes, and that storetype 2 is the least dense of the storetypes.

How many stores are there for each storetype?

# How many stores are there for each StoreType?

df['StoreType'].value_counts()StoreType

1 457043

4 258768

3 112968

2 15561

As we observed in the KDE plot, storetype 1 is the most common storetype, while storetype 2 is the least common storetype.

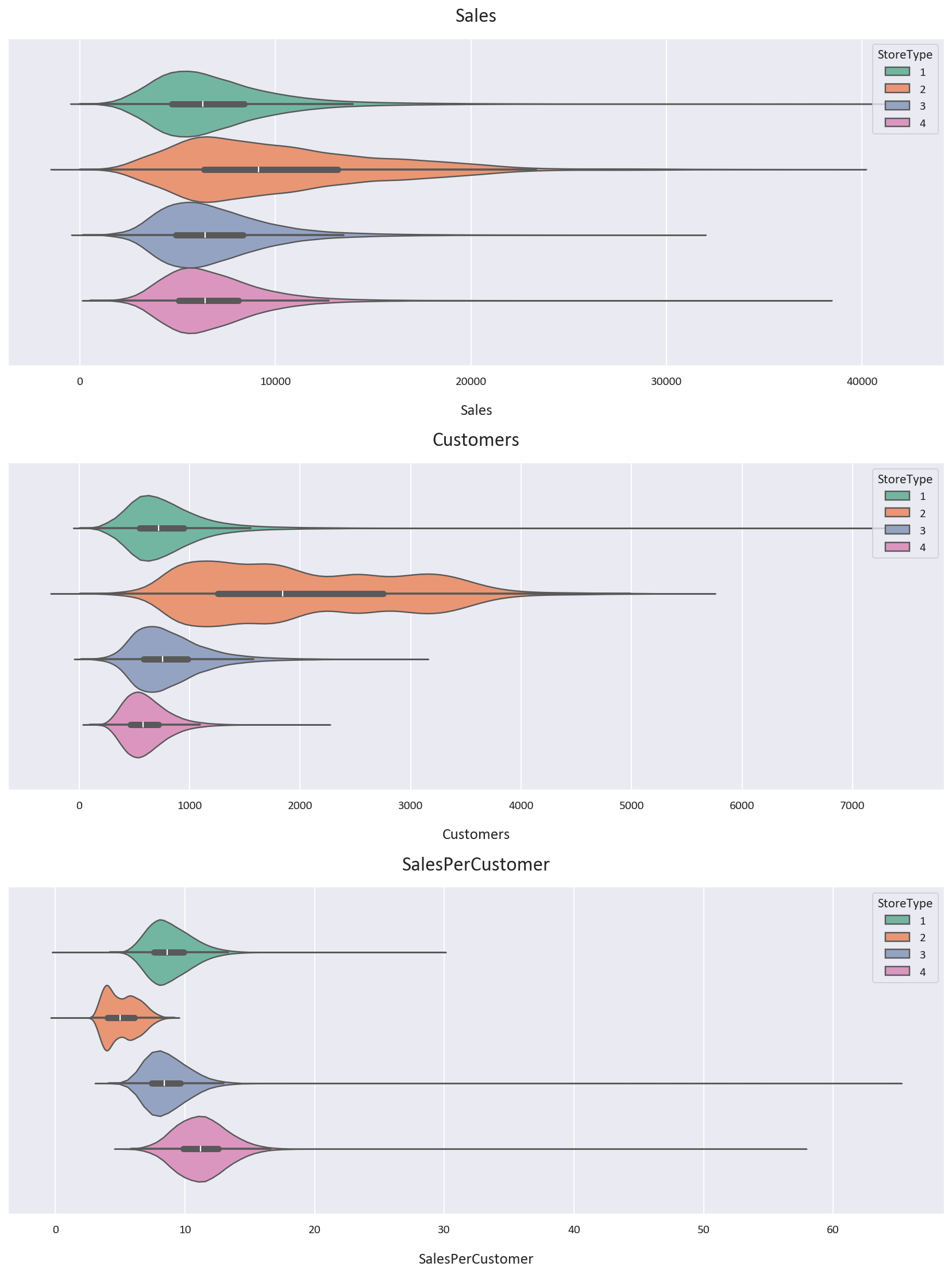

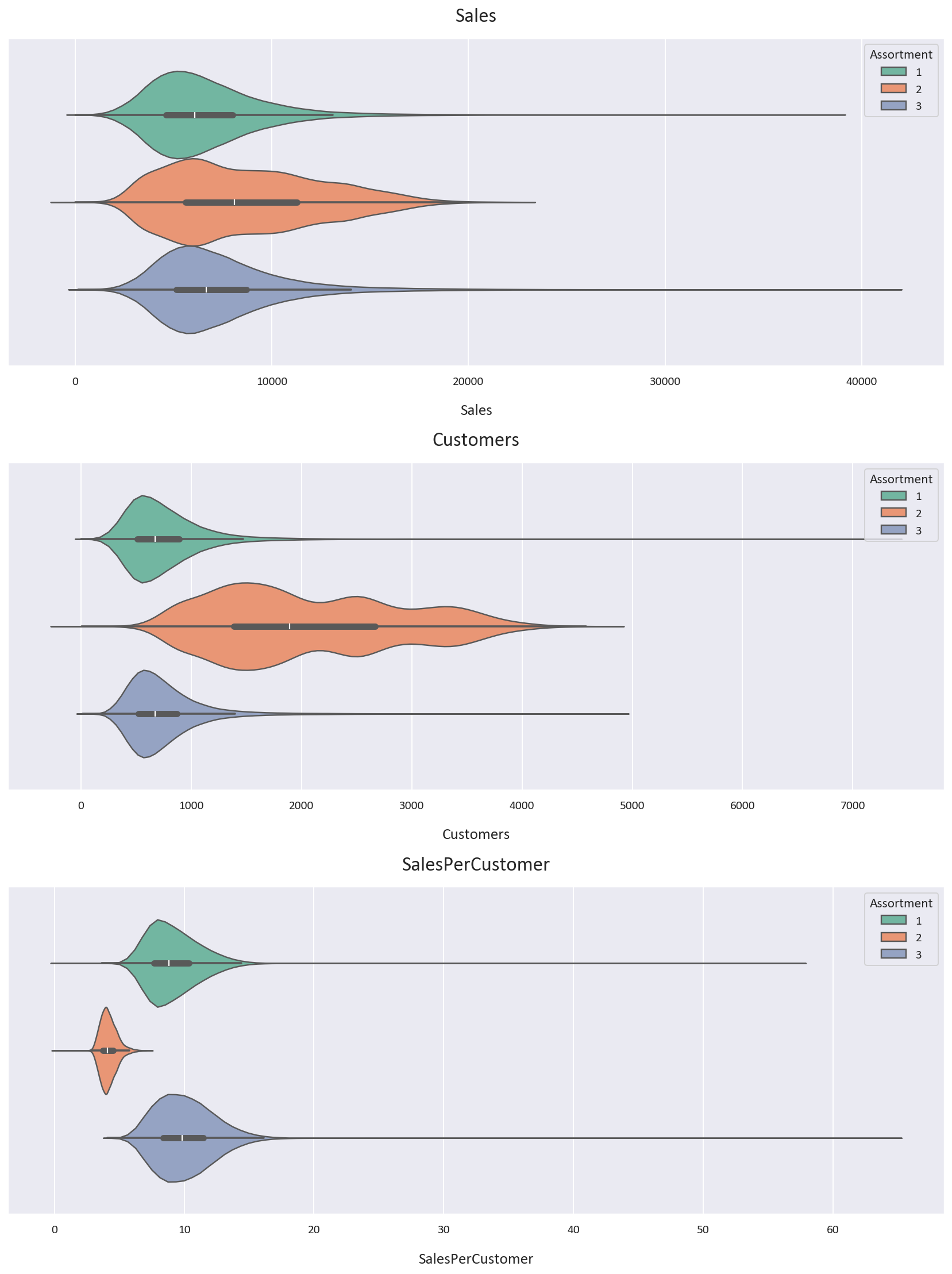

Let’s plot a Violin Plot to get a better understanding of the data.

Let’s also inspect the statistics of the data for each storetype.

Based on the Violin Plot and the statistics, we notice some interesting points:

- Storetype 1 has more customers than storetype 4, but storetype 4 has more high-value customers, with the average customer paying 2.43 euros more than the average customer in storetype 1 and the median customer paying 2.56 euros more than the median customer in storetype 1.

- Storetype 2 has double the customers of the next highest storetype, but it has the least sales per customer, being almost half the sales per customer value of the next lowest value. It also has the highest average sales. Note that the data is scarce for storetype 2, so we should take this with a grain of salt.

- We also notice that storetype 2 is spread out the most, with the highest standard deviation for Sales and Customers, while storetype 4 is the least spread out, with the lowest standard deviation for Sales and Customers.

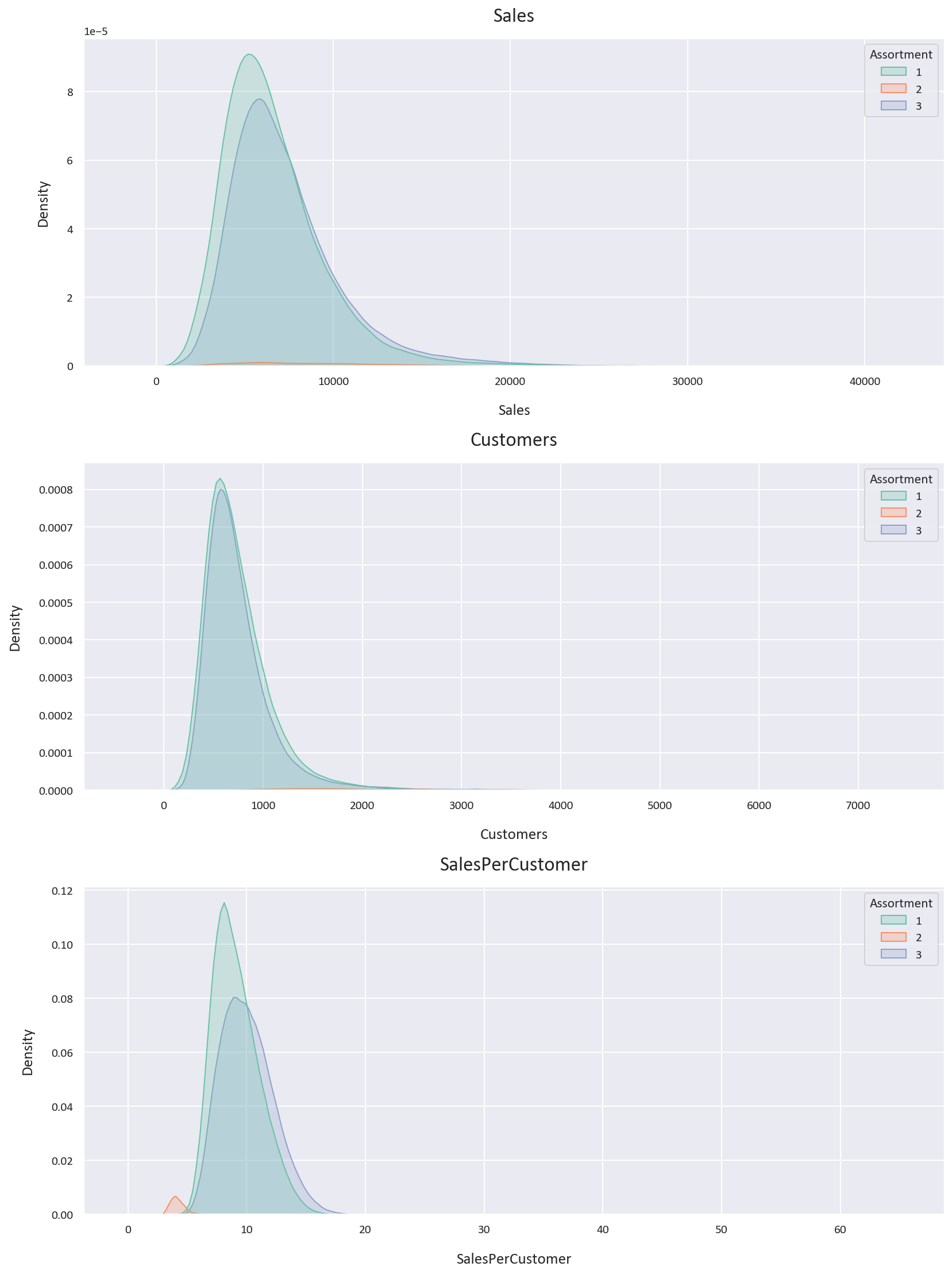

Let’s now plot the KDE plot for the Sales, Customers, and SalesPerCustomer columns for each Assortment level.

Let’s also look at the violin plots for the Sales, Customers, and SalesPerCustomer columns for each Assortment level.

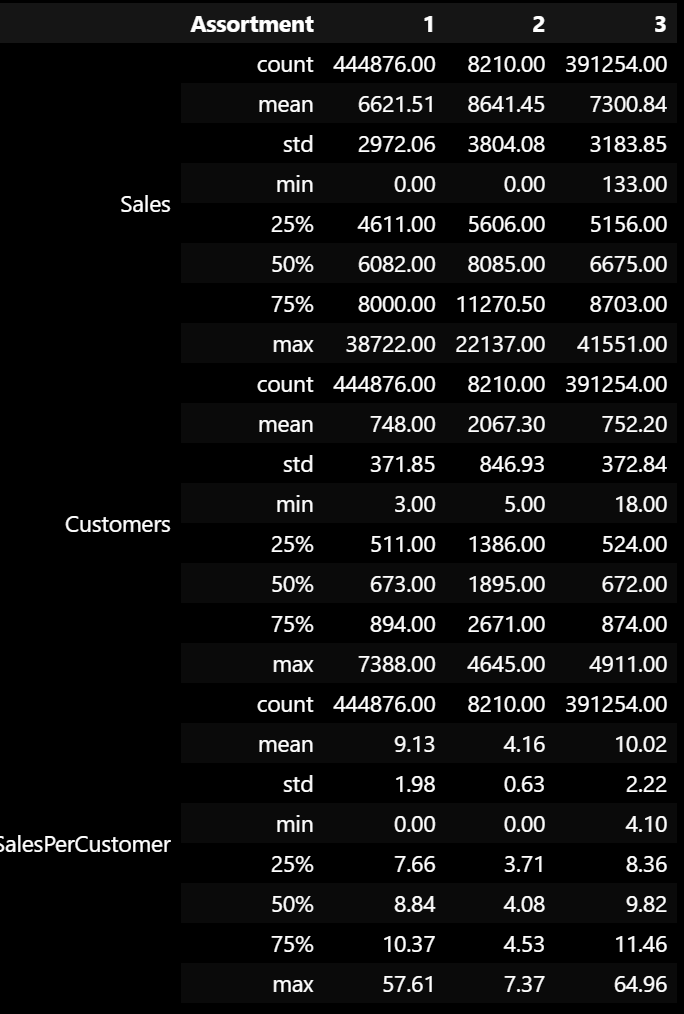

Let’s also inspect the statistics of the data for each Assortment level.

Based on the Violin Plot and the statistics, we notice some interesting points:

- Assortment type 2 has the most average and median sales and customers. It also has the least average and median sales per customer, being less than half of the other 2 assortments. This means that the customers in assortment type 2 spend less money than the customers in the other 2 assortments. It also is the most spread out, with the highest standard deviation for Sales and Customers. The data is also scarce for assortment type 2, so we should take these findings with a grain of salt as well.

- Assortment type 3 has more average and median sales, customers, and sales per customer than assortment type 1. It seems that assortment type 3 is the most profitable assortment, ignoring assortment type 2 as the data is less than 1% of the total data. This could be because assortment type 3 has the most products, so it has the most variety for the customers to choose from.

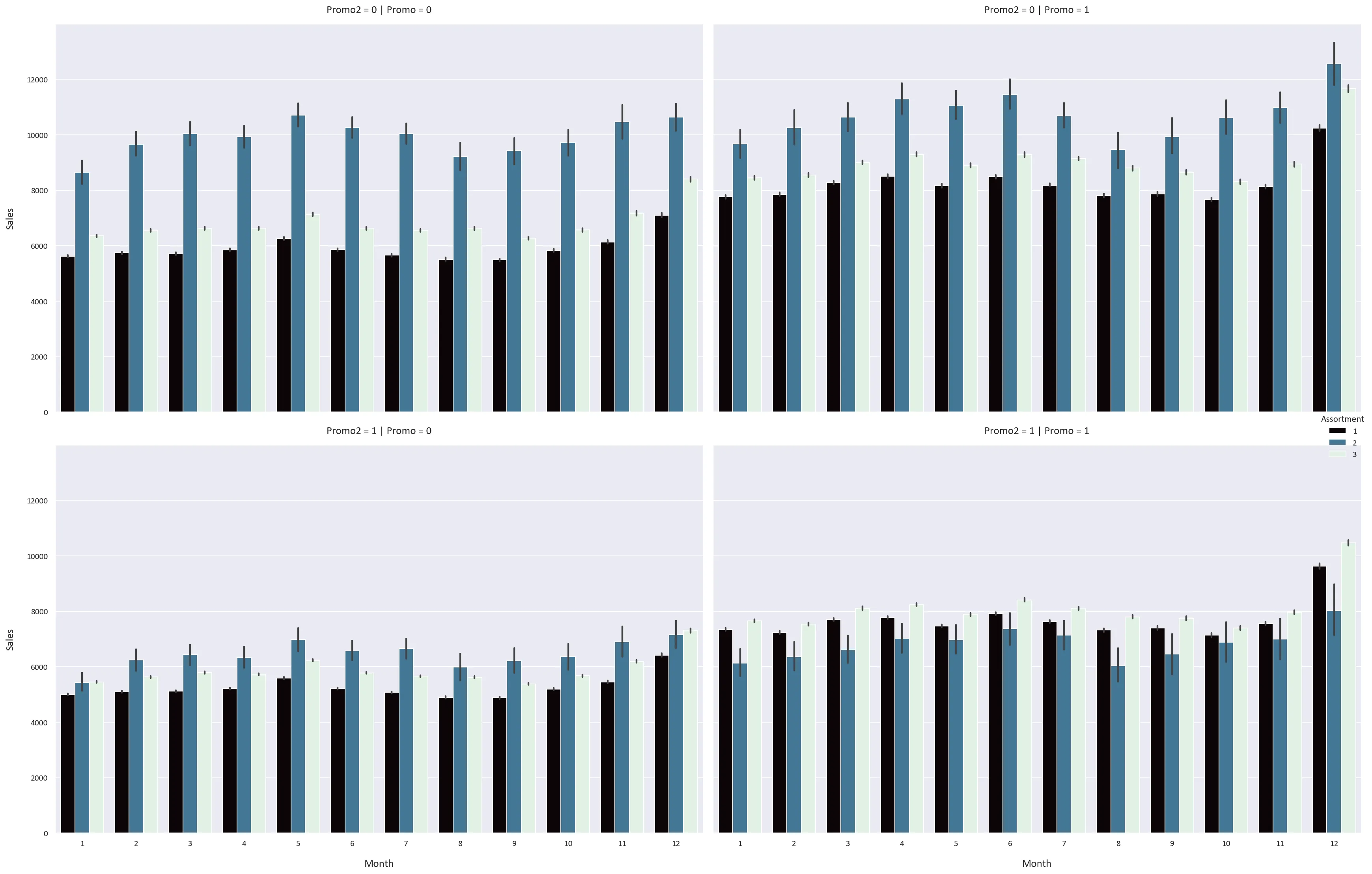

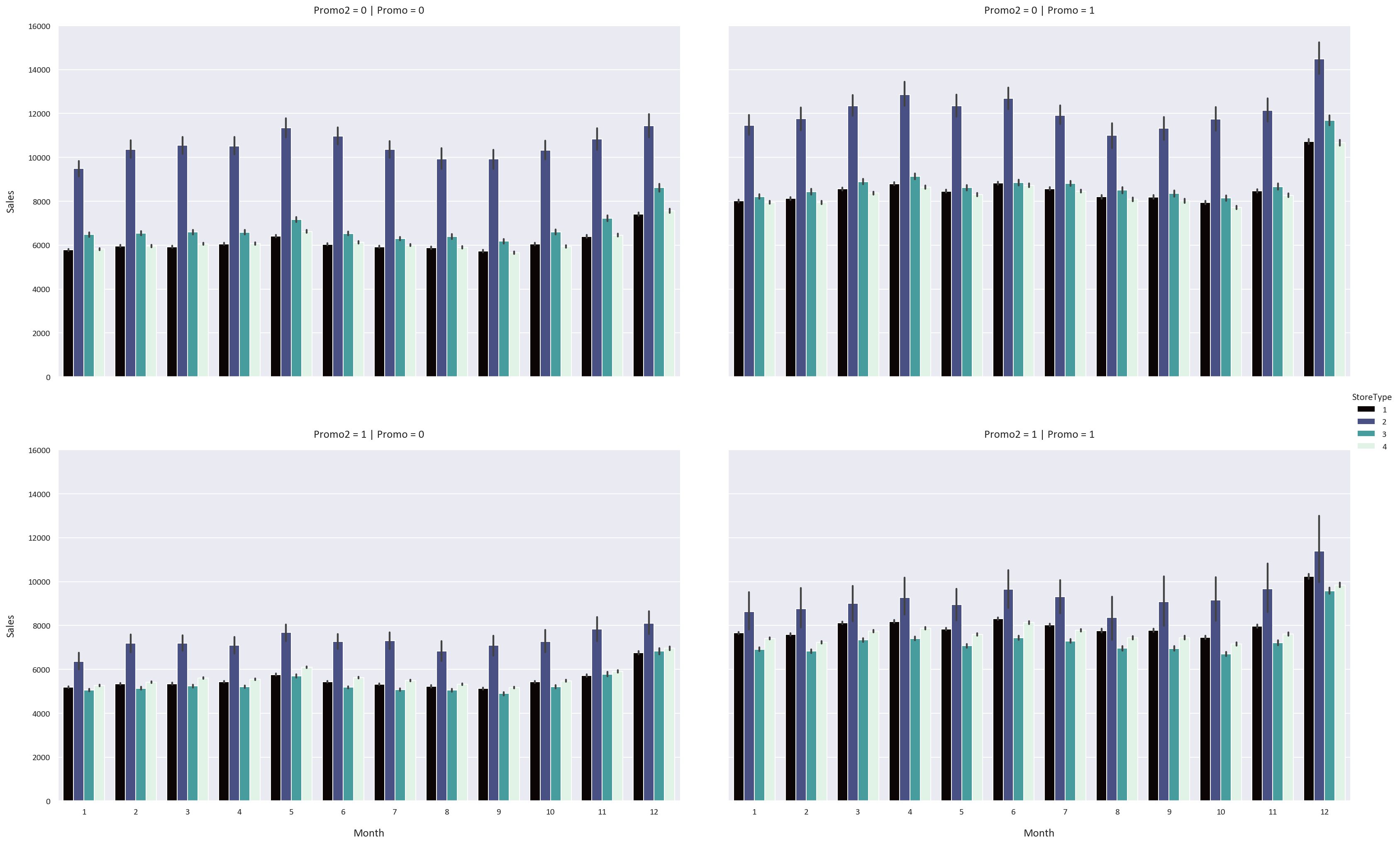

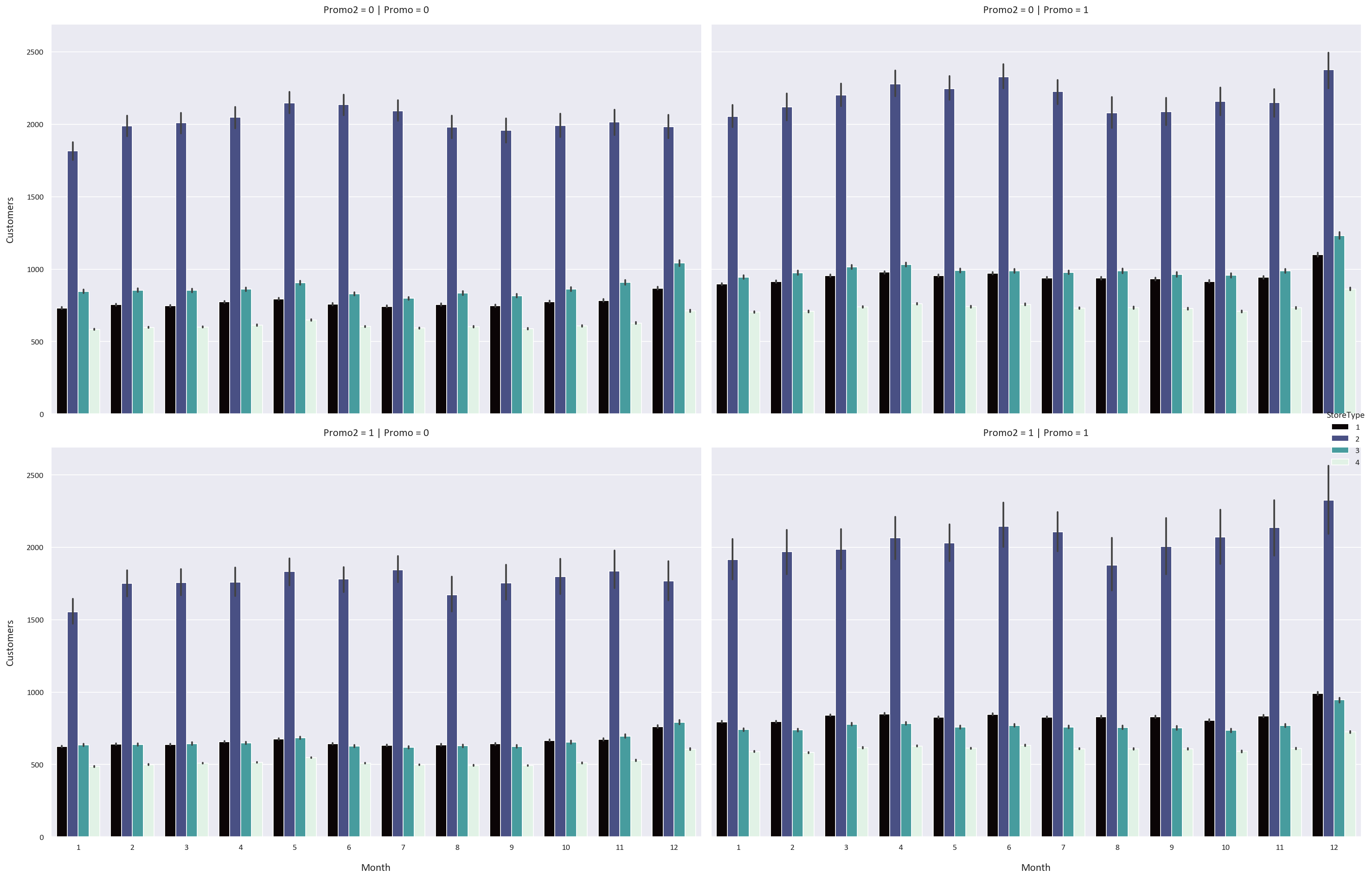

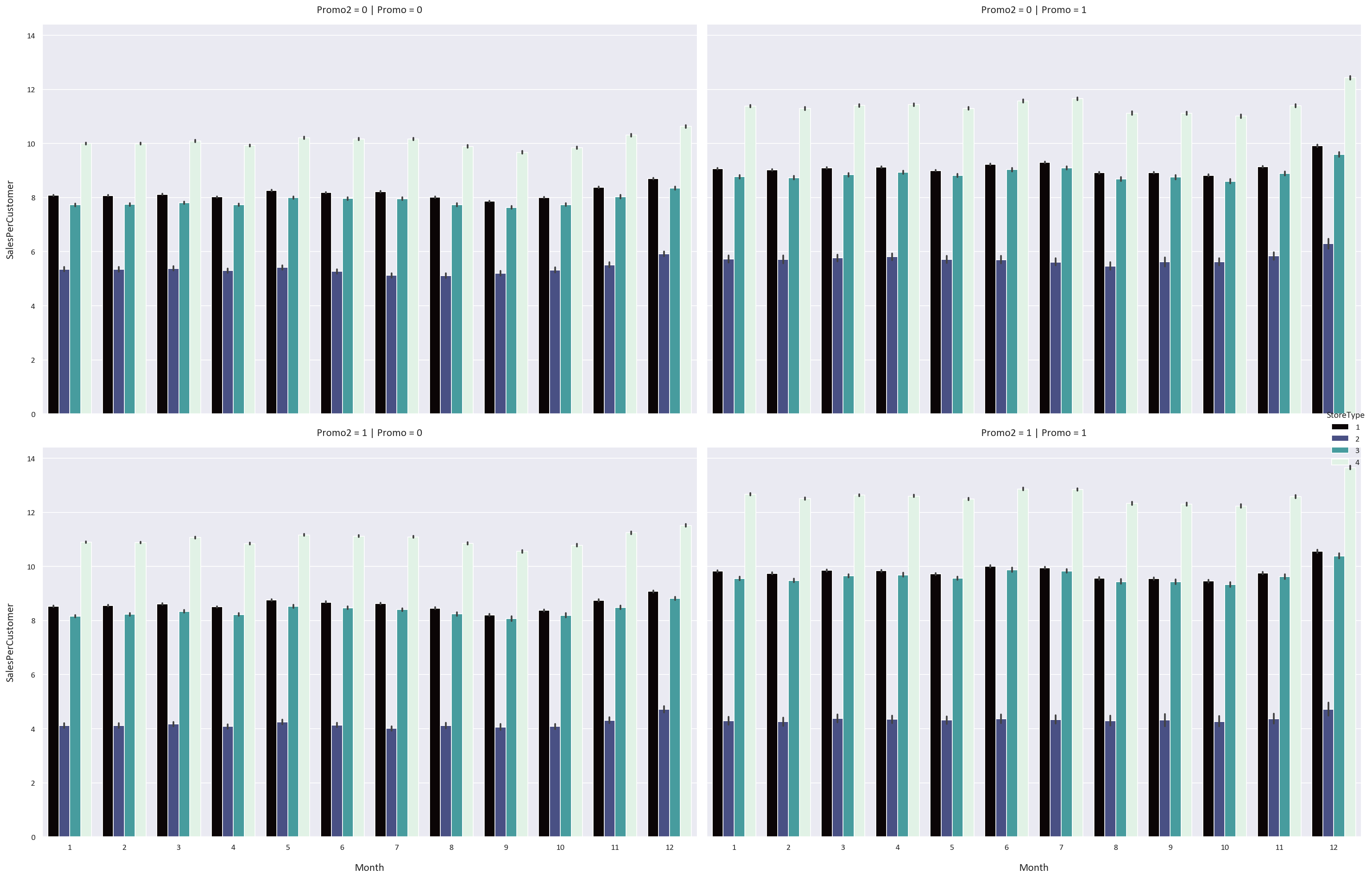

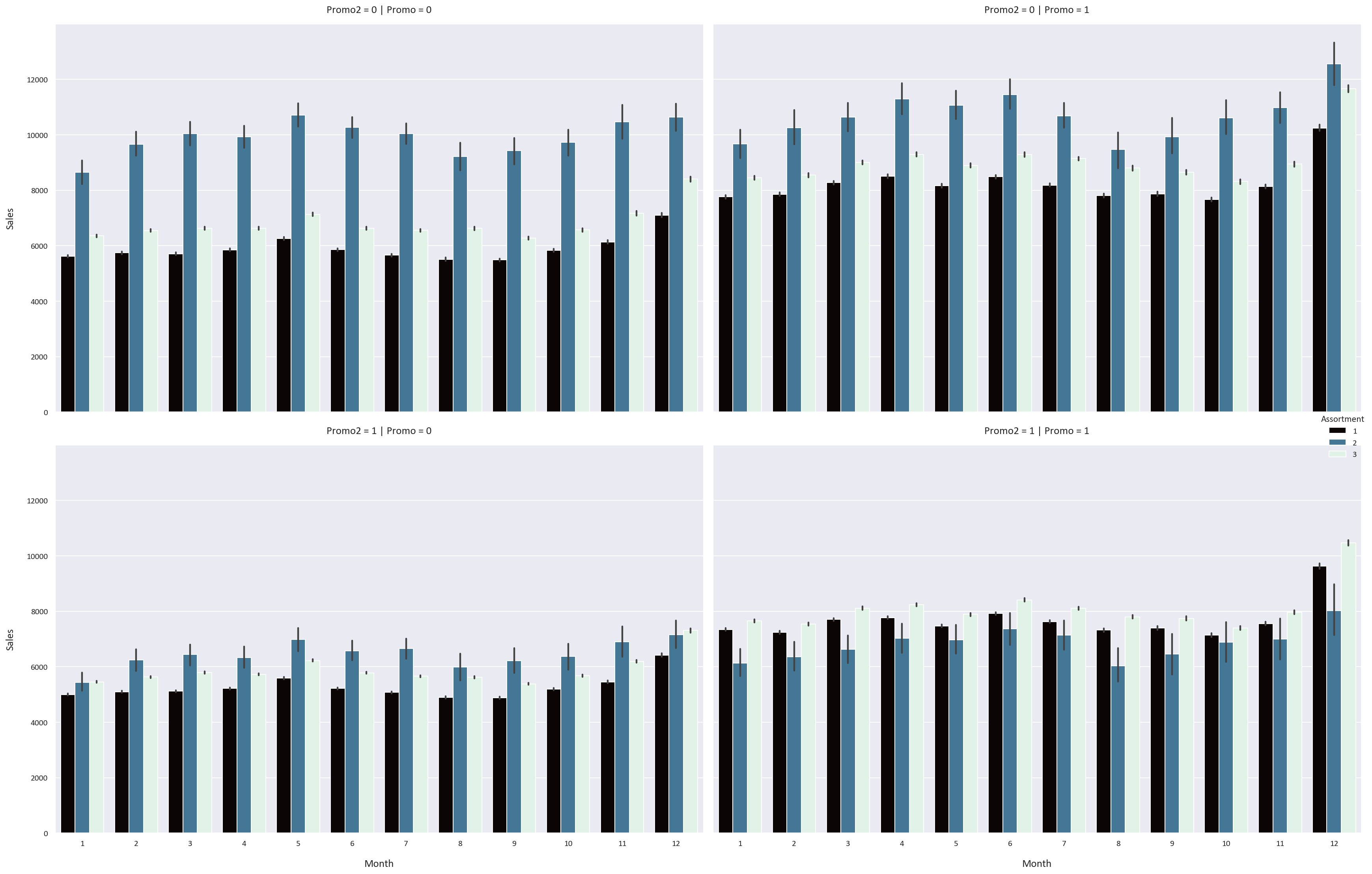

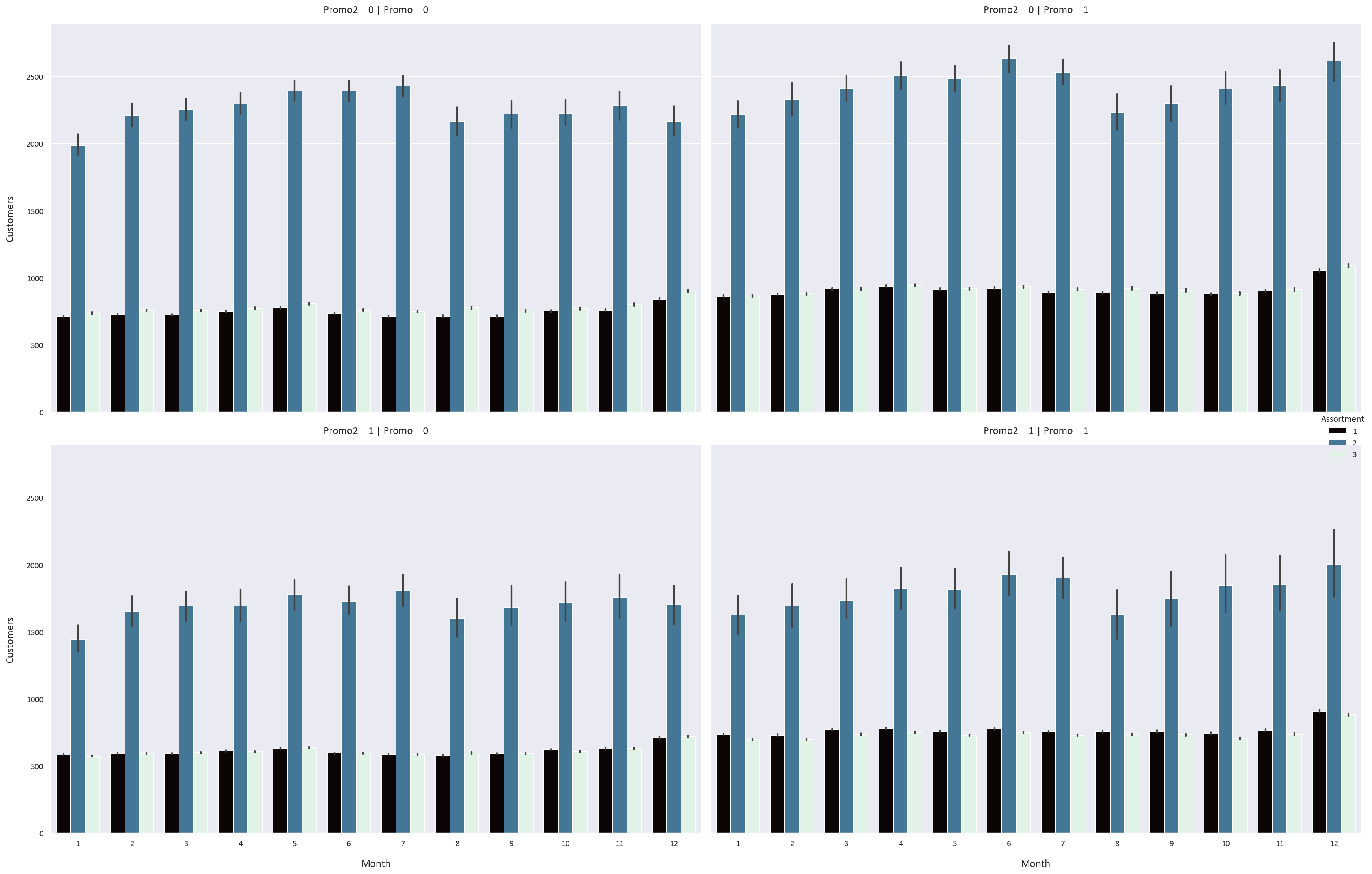

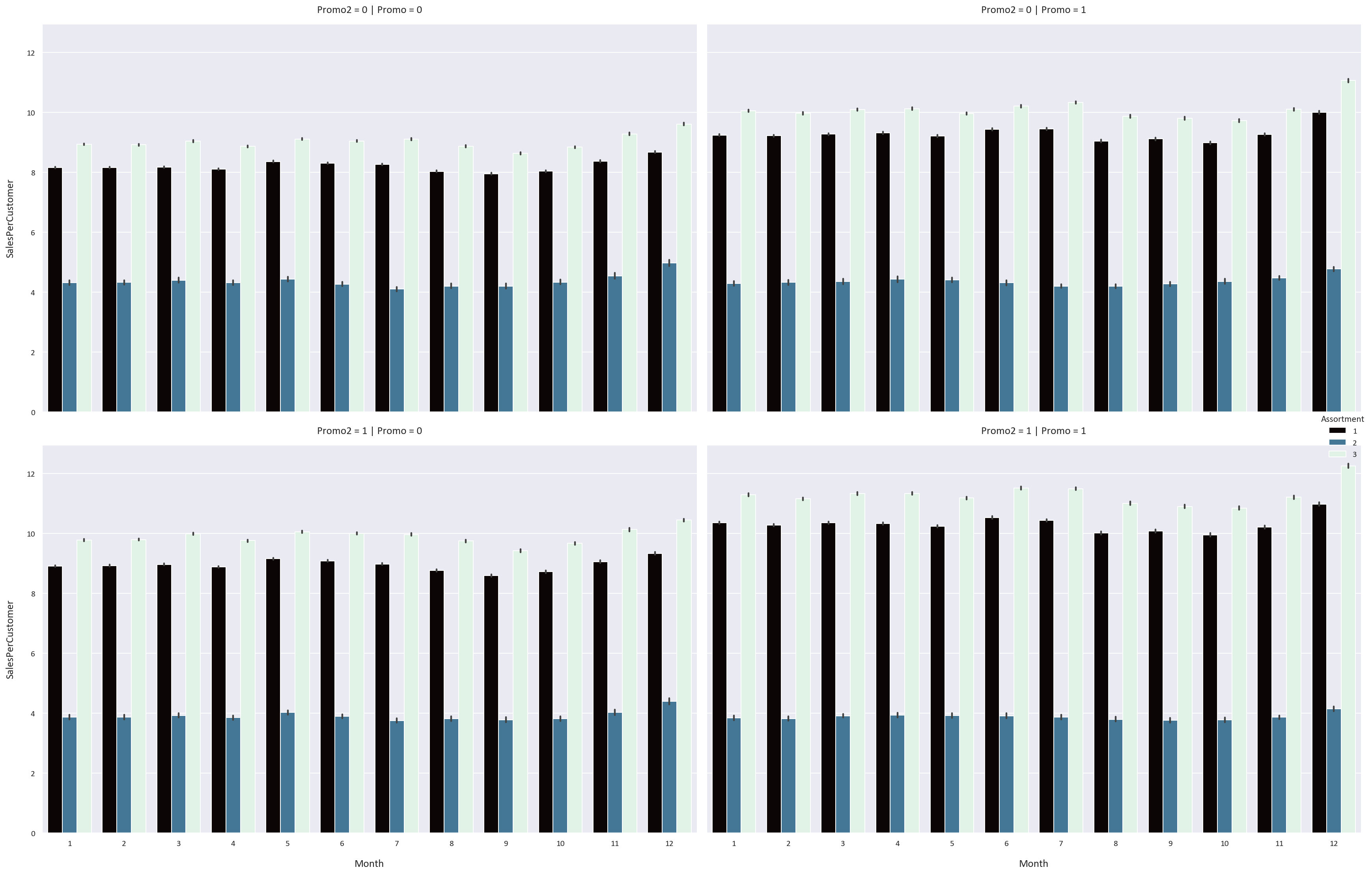

Let’s now look at how the month, promo, and promo2 features affect the sales, customers, and sales per customer for each storetype and assortment type. We use a plot called a Catplot, which is a combination of a bar plot and a violin plot for each combination of feature values.

# Plot a Catplot of the Monthly Sales based on the StoreType, Promo, and Promo2 columns

plt.figure(figsize=(16, 10))

sns.catplot(data=df, x='Month', y='Sales', hue='StoreType', kind='bar', col='Promo', row='Promo2', height=8, aspect=1.5, palette='mako')

plt.tight_layout(pad=5)

We notice some interesting patterns:

- The Promo feature increases the sales, customers, and sales per customer for all storetypes and assortment types by a significant margin. This means that the stores should have more promotions to increase their sales and customers.

- However, the Promo2 feature has an adverse effect on the sales, customers, and sales per customer for all storetypes and assortment types. We know that the Promo2 feature is a continuing and consecutive promotion, so perhaps a continuous promotion is not as effective as a one-time promotion.

- We also notice that the sales, customers, and sales per customer are highest in December and lowest in January. This could be because people buy more in December because of the sales and promotions that happen, while they buy less in January because they spent a lot of money in December.

Sales Forecasting

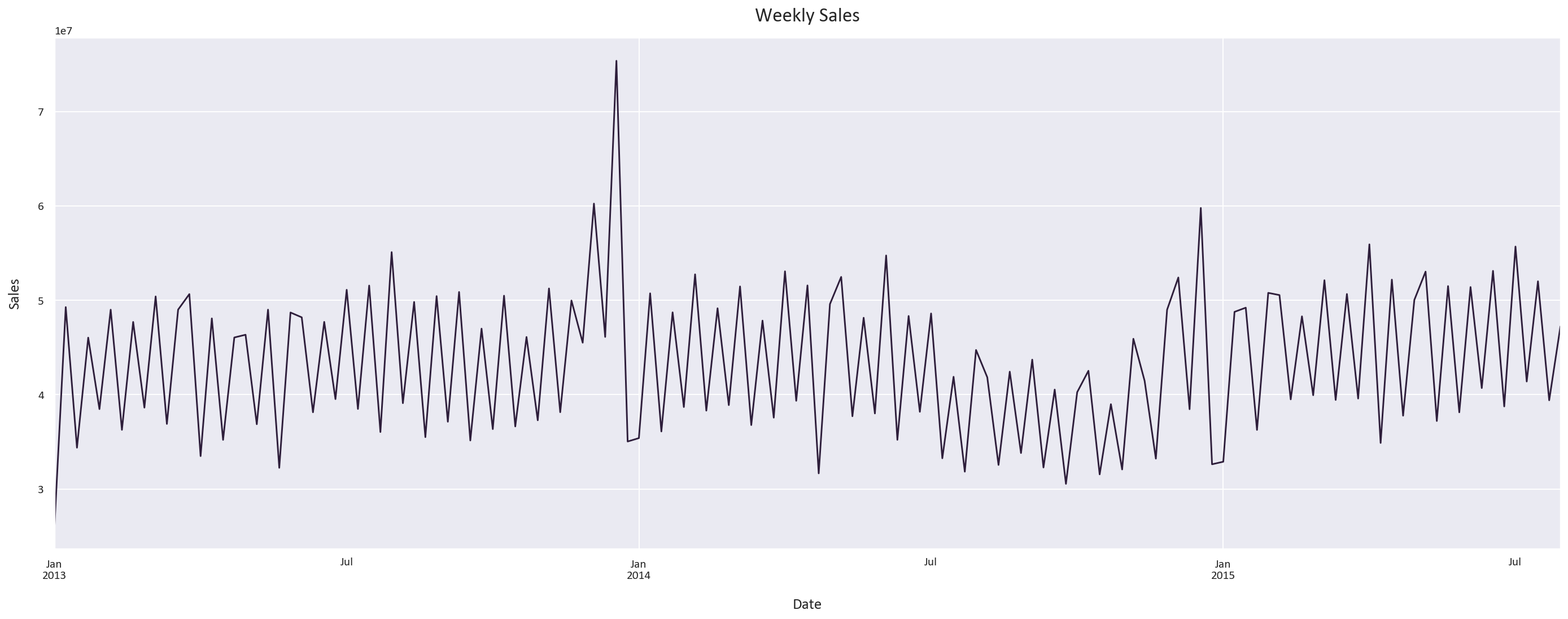

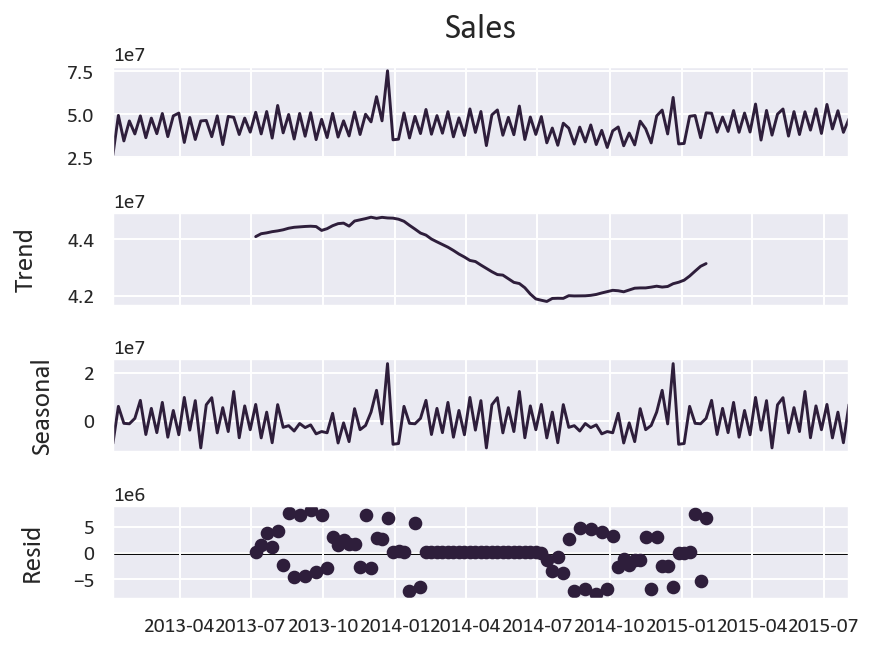

Let’s first resample the data to a weekly frequency to identify the trend, seasonality, noise, and autocorrelation in the data.

- Trend is when the data is increasing or decreasing over time.

- Seasonality is when the data is cyclic over a specific period.

- Noise is random fluctuations in the data.

- Autocorrelation is a little bit more complex, it is when the data is correlated with itself over time. For example, if it is rainy today, it is more likely to be rainy tomorrow. If the sales are high in a week, it is more likely to be high the next week.

# Resample the data to get the weekly sales

weekly_sales = df['Sales'].resample('W').sum()

plt.figure(figsize=(20, 8))

weekly_sales.plot()

plt.title('Weekly Sales')

plt.xlabel('Date')

plt.ylabel('Sales')

plt.tight_layout()

Let’s now plot the trend, seasonality, and noise in the data.

-

We notice a clear seasonality pattern, with the sales increasing in December, decreasing in January, and fluctuating throughout the rest of the year.

-

The trend isn’t as clear, as the data is over a short period of time.

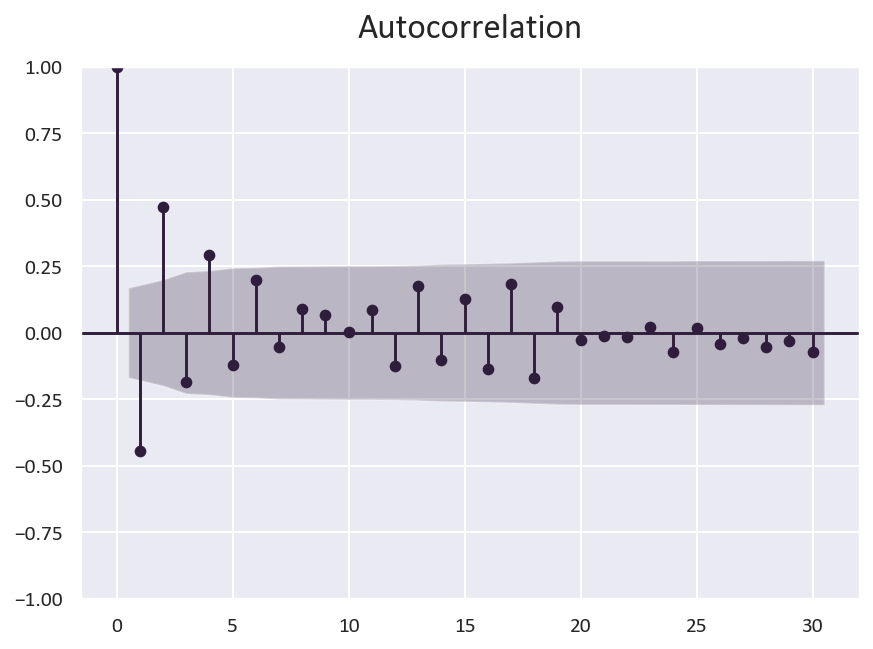

What about autocorrelation?

We can conclude that there is some autocorrelation in the data, but it is not very strong. You can see it when a portion of the data is above the confidence interval, like in the 0 to 5 range.

Another property of the data is the stationarity of the data. Stationarity means that the data is consistent over time. We can check this by plotting the rolling mean and standard deviation of the data.

The data being stationary is a good indicator for the models to perform better, as the data is consistent over time.

# Is the data stationary?

from statsmodels.tsa.stattools import adfuller

# Perform the Dickey-Fuller test

result = adfuller(weekly_sales)

# Print the p-value

print('p-value: ', result[1])p-value: 0.0020208588880313446

The p-value is less than 0.05, which means that the data is stationary.

Model Building and Evaluation

Based on the trend, seasonality, noise, and autocorrelation, I think that the best model for this data is one not based on time series, but rather a regression model.

This is because there are many features that can be used to predict the sales, such as the storetype, assortment type, promo, promo2, and competition distance. If we use a time series model, we will not be able to use these features and would be relying only on the trend, seasonality, noise, and autocorrelation. As these properties are not very strong, the model will not be accurate.

We will be using a Random Forest Regressor, as it is a powerful ensemble model that can handle complex relationships between variables. It works by creating many decision trees and combining their predictions to create a more accurate prediction while reducing overfitting.

We will also try a XGBoost Regressor, which works similarly to the Random Forest Regressor, but it iteratively constructs decision trees, where each new tree is built to reduce the errors of the previous tree. This model is very powerful and can achieve state-of-the-art results on a variety of difficult machine learning tasks.

As for the evaluation methods we will use four metrics:

- Mean Absolute Error (MAE): the mean of the absolute value of the errors. This is the easiest metric to understand, as it is simply the average error.

- Mean Absolute Percentage Error (MAPE): the mean of the absolute value of the percentage errors, or the absolute percentage difference between the actual and predicted values. This is a good metric to use when we want to minimize the effect of outliers. However, it is not very useful when the actual values are close to zero, as the percentage error will be very high. It can be from 0% to infinity, with 0% being a perfect prediction.

This is its formula:

MAPE = (1/n) * ∑(|Predicted - Actual| / |Actual|) * 100%

- Symmetric Mean Absolute Percentage Error (SMAPE): SMAPE is calculated as the mean of the absolute value of the percentage errors, but the absolute difference is divided by the sum of the mean of the absolute values of the actual and predicted values. This is a better metric to use for outlier-heavy data as it is symmetric, meaning that it doesn’t matter if the actual value is larger or the predicted value is larger. It can be from 0% to 200%, with 0% being a perfect prediction and 200% being the worst prediction possible.

This is its formula:

SMAPE = (1/n) * ∑(|Predicted - Actual| / (|Actual| + |Predicted|)/2) * 100%

- R2 Score: the proportion of the variance in the dependent variable that is predictable from the independent variable(s). It is useful for determining how well the model explains the variance in the data. It can be from 0 to 1, with 1 meaning the model explains all the variance in the data and 0 meaning the model explains none of the variance in the data. Of course, having an R2 score close to 1 is not always a good thing, as it could mean that the model is overfitting. For human behavior related studies, the R2 score is usually less than 0.5, as human behavior is harder to predict than physical behavior. Reference

Data Preparation

First, let’s prepare our features and target variables:

# Define features and target while dropping non-predictive columns

X = df.drop(['Sales', 'Store', 'Customers', 'SalesPerCustomer'], axis=1)

y = df['Sales']

# Split into training and testing sets

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.2, random_state=0)Random Forest Model

We’ll start with a Random Forest model using carefully chosen hyperparameters:

# Initialize Random Forest with optimal parameters

rf = RandomForestRegressor(

n_estimators=300, # Number of trees

random_state=0, # For reproducibility

n_jobs=-1, # Use all available cores

verbose=1, # Show training progress

max_depth=30 # Prevent overfitting

)

# Train the model

rf.fit(X_train, y_train)

# Make predictions

y_pred = rf.predict(X_test)

# Evaluate performance

mae = mean_absolute_error(y_test, y_pred)

mape = np.mean(np.abs((y_test - y_pred) / y_test)) * 100

smape = np.mean(2 * np.abs(y_pred - y_test) / (np.abs(y_test) + np.abs(y_pred))) * 100

r2 = r2_score(y_test, y_pred)

print('Random Forest Metrics:')

print(f'Mean Absolute Error: {mae:.2f}')

print(f'Mean Absolute Percentage Error: {mape:.2f}%')

print(f'Symmetric Mean Absolute Percentage Error: {smape:.2f}%')

print(f'R2 Score: {r2:.2f}')Random Forest Metrics:

Mean Absolute Error: 1115.2309882185264

Mean Absolute Percentage Error: 17.401195204365806

Symmetric Mean Absolute Percentage Error: 16.12417120245528

R2 Score: 0.704369772527475

XGBoost Model

Next, let’s implement an XGBoost model with optimized parameters:

import xgboost as xgb

# Initialize XGBoost with optimal parameters

xgb_reg = xgb.XGBRegressor(

n_estimators=300, # Number of boosting rounds

random_state=0, # For reproducibility

objective='reg:absoluteerror', # Optimize for MAE

max_depth=10 # Control model complexity

)

# Train the model

xgb_reg.fit(X_train, y_train)

# Make predictions

y_pred_xgb = xgb_reg.predict(X_test)

# Evaluate performance

mae_xgb = mean_absolute_error(y_test, y_pred_xgb)

mape_xgb = np.mean(np.abs((y_test - y_pred_xgb) / y_test)) * 100

smape_xgb = np.mean(2 * np.abs(y_pred_xgb - y_test) / (np.abs(y_test) + np.abs(y_pred_xgb))) * 100

r2_xgb = r2_score(y_test, y_pred_xgb)

print('XGBoost Metrics:')

print(f'Mean Absolute Error: {mae_xgb:.2f}')

print(f'Mean Absolute Percentage Error: {mape_xgb:.2f}%')

print(f'Symmetric Mean Absolute Percentage Error: {smape_xgb:.2f}%')

print(f'R2 Score: {r2_xgb:.2f}')XGBoost Metrics:

Mean Absolute Error: 1031.599894705175

Mean Absolute Percentage Error: 16.021434332031838

Symmetric Mean Absolute Percentage Error: 15.124611440443609

R2 Score: 0.7304052654222772

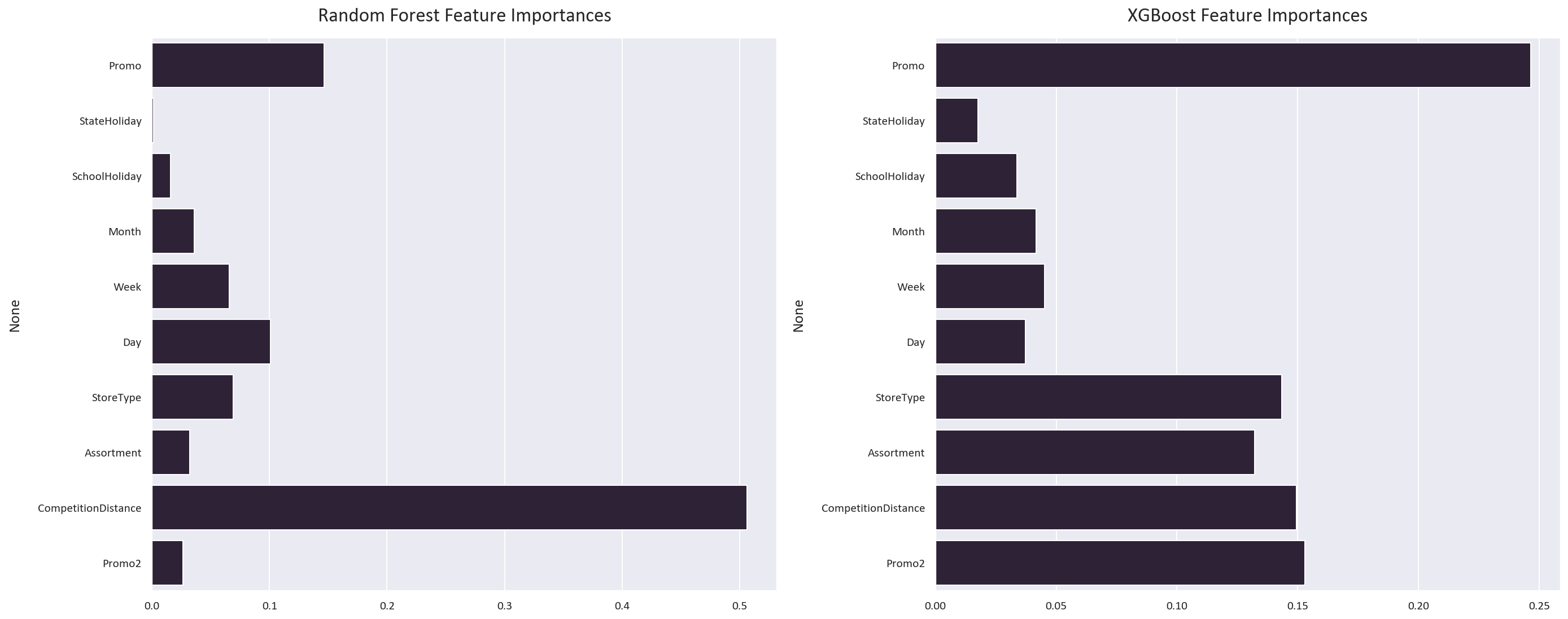

Feature Importance Analysis

Understanding which features are the most important for the model is a good way to understand how the model is making predictions.

# Plot feature importances for both models

plt.figure(figsize=(20, 8))

plt.subplot(1, 2, 1)

sns.barplot(x=rf.feature_importances_, y=X.columns)

plt.title('Random Forest Feature Importances')

plt.subplot(1, 2, 2)

sns.barplot(x=xgb_reg.feature_importances_, y=X.columns)

plt.title('XGBoost Feature Importances')

plt.tight_layout()

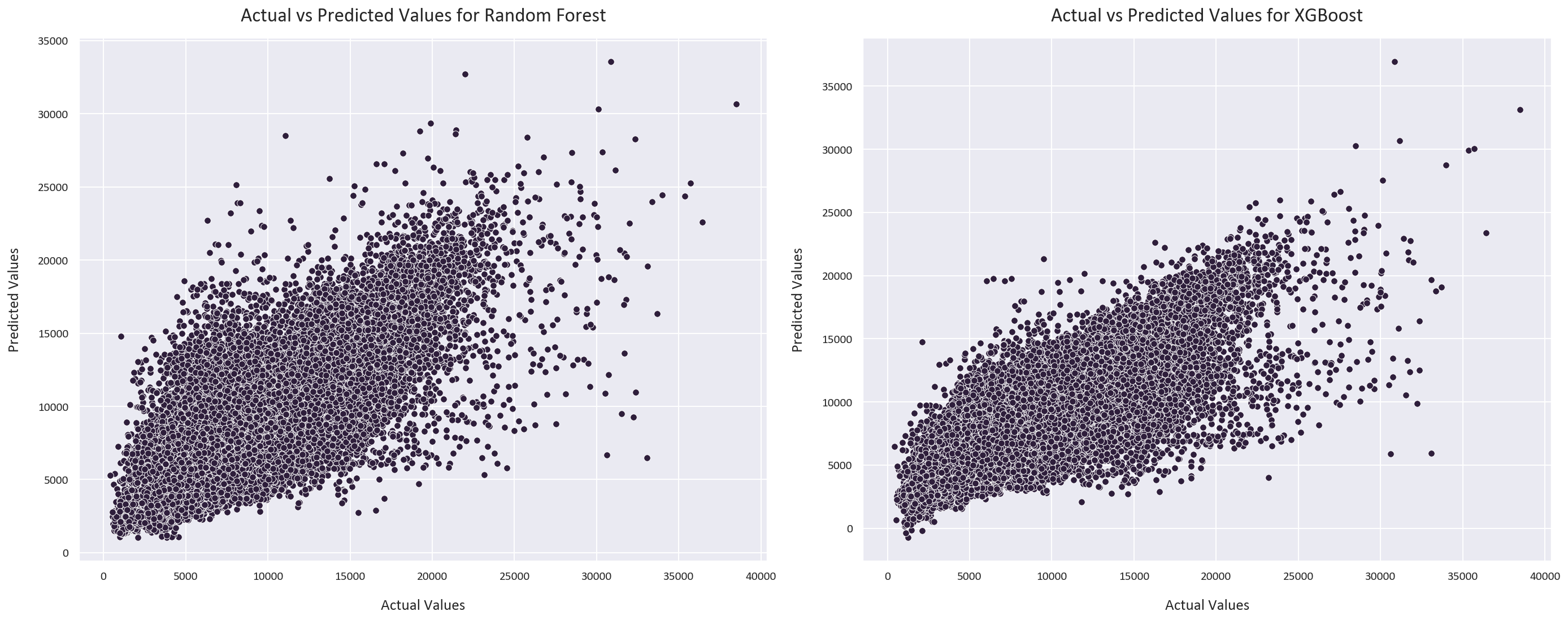

Model Comparison

Let’s visualize how well our models predict actual sales:

plt.figure(figsize=(20, 8))

plt.subplot(1, 2, 1)

sns.scatterplot(x=y_test, y=y_pred)

plt.xlabel('Actual Values')

plt.ylabel('Predicted Values')

plt.title('Random Forest: Actual vs Predicted')

plt.subplot(1, 2, 2)

sns.scatterplot(x=y_test, y=y_pred_xgb)

plt.xlabel('Actual Values')

plt.ylabel('Predicted Values')

plt.title('XGBoost: Actual vs Predicted')

plt.tight_layout()

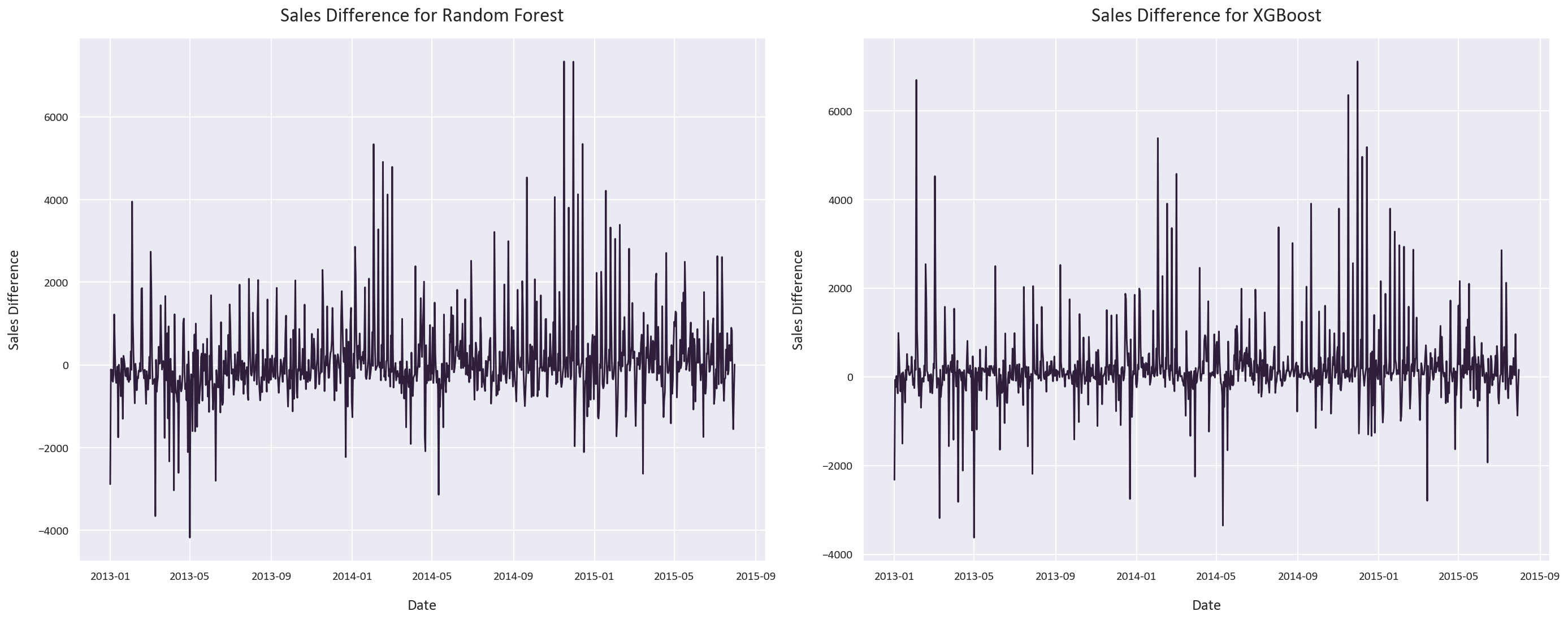

# Plot prediction differences

plt.figure(figsize=(20, 8))

plt.subplot(1, 2, 1)

sns.lineplot(x=y_test.index, y=y_test - y_pred, ci=None)

plt.xlabel('Date')

plt.ylabel('Sales Difference')

plt.title('Random Forest: Prediction Error Over Time')

plt.subplot(1, 2, 2)

sns.lineplot(x=y_test.index, y=y_test - y_pred_xgb, ci=None)

plt.xlabel('Date')

plt.ylabel('Sales Difference')

plt.title('XGBoost: Prediction Error Over Time')

plt.tight_layout()

The random forest regressor’s predictions are more spread out, while the XGBoost regressor’s predictions are more concentrated around the line of best fit.

The random forest regressor’s prediction error is more general, while the XGBoost regressor’s prediction error has spikes instead of regions of high error.

Model Performance Summary

Both models performed exceptionally well:

Random Forest:

- MAE: 1,115 euros

- SMAPE: 16.12%

- R² Score: 0.70

XGBoost:

- MAE: 1,031 euros

- SMAPE: 15.12%

- R² Score: 0.73

The XGBoost model slightly outperformed Random Forest, likely due to its ability to:

- Learn from its mistakes through boosting

- Handle non-linear relationships more effectively

- Capture complex feature interactions

- It learnt that the promo and promo2 features are important, while the random forest model did not.

The high R² scores (0.70-0.73) indicate strong predictive power, especially considering the complexity of sales forecasting where many external factors can influence outcomes.

Testing the models

Let’s test the models on the test set:

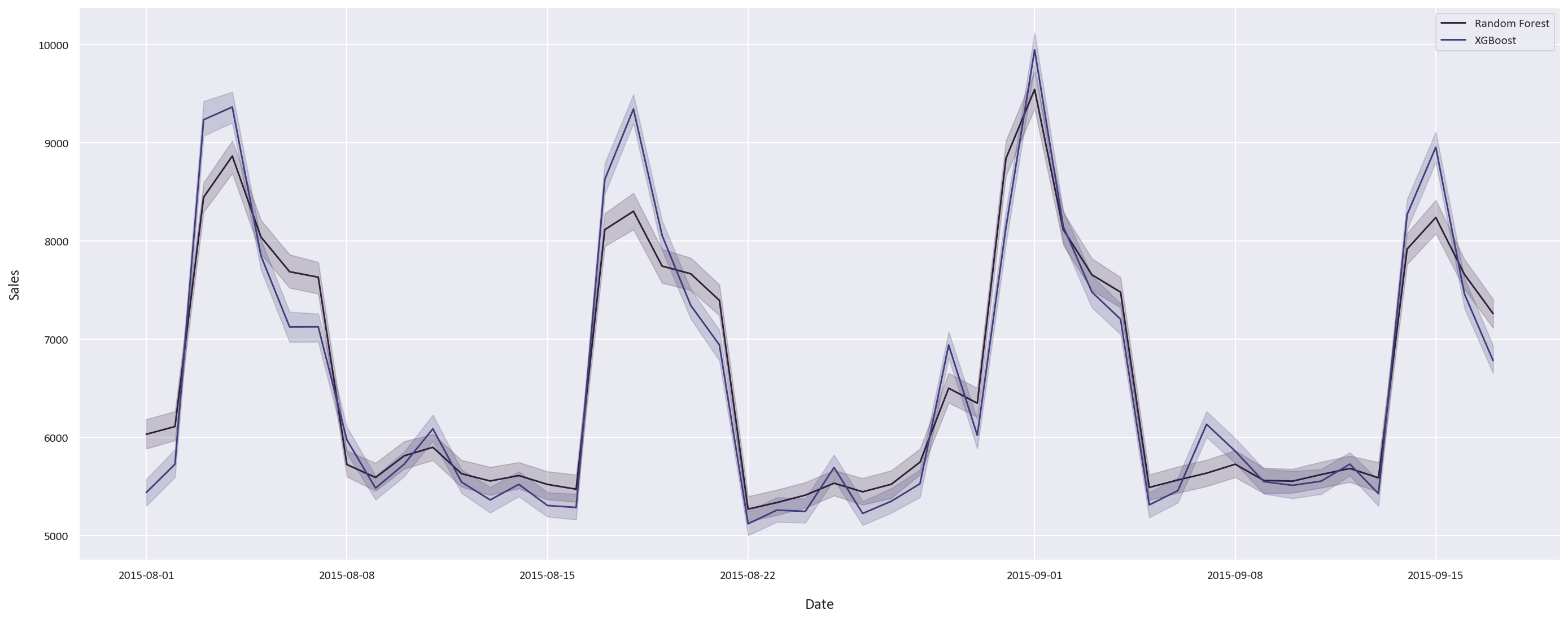

# Plot both predictions with 95% confidence intervals

plt.figure(figsize=(20, 8))

sns.lineplot(x=test.index, y=test_pred, label='Random Forest', ci=95)

sns.lineplot(x=test.index, y=test_pred_xgb, label='XGBoost', ci=95)

plt.xlabel('Date')

plt.ylabel('Sales')

plt.legend()

plt.tight_layout()

The two models’ predictions are fairly close, this was expected as they performed similarly on the training data. The results are very promising, and the models are able to predict the sales very well.

Conclusion

Our sales forecasting project successfully demonstrated the power of ensemble methods in predicting retail sales. Key achievements include:

-

Data Preprocessing

- Handled missing values appropriately for different feature types

- Engineered temporal features from date information

- Cleaned and standardized categorical variables

-

Feature Engineering

- Created meaningful derived features like SalesPerCustomer

- Identified and removed redundant competition metrics

- Preserved important features based on correlation analysis

-

Model Performance

- Achieved R² scores above 0.70 with both models

- XGBoost slightly outperformed Random Forest

- Mean Absolute Errors around 1,000 euros

-

Business Insights

- Identified key sales drivers through feature importance

- Discovered counterintuitive competition-sales relationships

- Quantified promotion effectiveness

The techniques demonstrated here can be applied to various forecasting problems beyond retail sales, such as:

- Inventory optimization

- Resource allocation

- Demand prediction

- Revenue forecasting

You can find the code for this project here .